- Groupe Danone

-

Groupe Danone S.A.

Type Société Anonyme Traded as Euronext: BN, OTCBB: GDNNY Industry Food processing Founded Barcelona, Spain (1919) Headquarters Boulevard Haussmann

9th arrondissement, Paris, FranceKey people Franck Riboud (Chairman and CEO), Jacques Vincent (Vice-Chairman and COO) Products Dairy products, water, baby food Revenue €17.01 billion (2010)[1] Operating income €2.578 billion (2010)[1] Profit €1.870 billion (2010)[1] Total assets €28.10 billion (end 2010)[1] Total equity €11.99 billion (end 2010)[1] Employees 101,000 (end 2010)[1] Website www.danone.com Groupe Danone is a French food-products multinational corporation based in the 9th arrondissement of Paris. It claims world leadership in fresh dairy products,[2] marketed under the corporate name, and also in bottled water. In 2007 it swapped its world number 2 position as producer of cereals and biscuits[2] for the same position in baby foods, having sold the biscuits division to Kraft Foods[3] and acquired Numico. In the United States, the Danone brand is marketed as Dannon, a subsidiary of Groupe Danone (under the name The Dannon Company).

Besides the Danone/Dannon brand of yogurts, the company owns several internationally known brands of bottled water: Volvic, Evian, and Badoit. About 56% of its 2006 net sales derived from dairy, 28% from beverages, and 16% from biscuits and cereals.[4]

Danone owns many water brands worldwide. In Asia, it has acquired Yili, Aqua (Indonesia) and Robust (92%) and has a 51% holding in China's Wahaha Joint Venture Company, giving it a total market share of 20% and making it the leading vendor of packaged water in Asia.

Contents

History

Name

The original company bearing the corporate name was founded in 1919 by Isaac Carasso in Barcelona (Spain) as a small factory producing yoghurt. The factory was named Danone, a Catalan diminutive of the name of his first son, Daniel Carasso.

Ten years later, the first French factory was built. During the German occupation of France during World War II, Daniel moved the company to New York to avoid persecution as a result of his Jewish faith. In the United States, Daniel partnered with the Swiss-born Spaniard Joe Metzger and changed the brand name to Dannon to sound more American.

In 1951, Daniel Carasso returned to Paris to manage the family's businesses in France and Spain, and the American business was sold in 1959. In Europe in 1967, Danone merged with Gervais, the leading fresh cheese producer in France and became Gervais Danone.

Glassmaking tradition

Another branch of Groupe Danone descended from industrial glassmaker Boussois-Souchon-Neuvesel (BSN), which was founded by the family of Antoine Riboud. After a failed attempted takeover battle for its larger rival Saint-Gobain, Riboud transformed it into one of Europe's leading food groups in the 1970s through a series of acquisitions and mergers, including the 1973 merger with Gervais Danone.

Strategic reorientation

The acquisitions initially took the shape of vertical integration, acquiring Alsacian brewer Kronenbourg and Evian mineral water who were the glassmaker's largest customers. This move provided content with which to fill the factory's bottles.[5] In 1973, the company merged with Gervais Danone and began to expand internationally. In 1979, the company abandoned glassmaking by disposing of Verreries Boussois. In 1987, Gervais Danone acquired European biscuit manufacturer Général Biscuit, owners of the LU brand, and, in 1989, it bought out the European biscuit operations of Nabisco.[6]

In 1994, BSN changed its name to Groupe Danone, adopting the name of the group’s best-known international brand. Franck Riboud succeeded his father, Antoine, as the company's chairman and chief executive officer in 1996 when Riboud senior retired. Under Riboud junior, the company continued to pursue its focus on three product groups (dairy, beverages, and cereals) and divested itself of several activities which had become non-core.

In 1999 and 2003, the group sold 56% and 44%, respectively, of its glass-containers business. In 2000, the group also sold most of its European beer activities (the brand Kronenbourg and the brand 1664 were sold to Scottish & Newcastle for UK£ 1.7 billion;[7] Its Italian cheese and meat businesses (Egidio Galbani Spa) were sold in March 2002;[8] as were its beer producing activities in China. The company's British (Jacob's) and Irish biscuit operations were sold to United Biscuits in September 2004.[9] In August 2005, the Group sold its sauces business in the United Kingdom and in the United States (HP Foods),[8] in January 2006, its sauces business in Asia (Amoy Food) was sold to Ajinomoto.[6] Despite these divestitures, Danone continues to expand internationally in its 3 core business units, emphasising health and well-being products.[10]

In July 2007, it was announced that Danone had reached agreement with Kraft to sell its biscuits division, including the LU and Prince brands, for around €5.3 billion.[3] Also in July 2007, a €12.3 billion cash offer by Danone for the Dutch baby food and clinical nutrition company Numico was agreed to by both boards,[11] creating the world's second largest manufacturer of baby food.

Protecting Danone

Due to its narrow focus and relatively small size, Danone is potentially an attractive takeover target for its competitors, namely Nestlé and Kraft Foods. In mid-July 2005, the share price of Danone rose 20% within two weeks on rumours of a bid approach by PepsiCo, although this intention was denied.[12] Upon realising that a takeover of a national treasure such as Danone by a foreign company was indeed possible in the capital markets, the "economically patriotic"[13] French government stepped in by drafting a law to protect companies in "strategic industries" such as Danone[14] from takeover. This has been dubbed the "Danone Law".[15]

Speculation was renewed once again in the summer of 2006, when PepsiCo declared its intention to grow significantly in France through a sizeable non-hostile acquisition,[16] and Kraft was also reported in Le Figaro, a French daily newspaper, as not having ruled out an acquisition on French soil.[17] The stock market apparently marked down the possibility of a bid by PepsiCo following Danone's acquisition of Numico.[18]

Corporate governance

Current members of the board of directors of Groupe Danone are Bruno Bonnell, Richard Goblet d'Alviella, Michel David-Weill, Emmanuel Faber, Jean Laurent, Naomasa Tsuritani, Bernard Hours, Christian Laubie, Hakan Mogren, Jacques-Alexandre Nahmias, Guylaine Saucier, Benoît Potier, Franck Riboud, and Jacques Vincent.

In 2004, the annual compensation of these individuals were Franck Riboud, €2,426,860, Jacques Vincent, €1,511,140, Emmanuel Faber, €746,430 [2].

Head office

Danone has its head office in the 17 Boulevard Haussmann building in the 9th arrondissement of Paris.[19] Previously the company's head office and its 500 employees were located in several buildings on Rue de Téhéran in the 8th arrondissement of Paris.[20][21] In 2002 the head office moved to its current location. Frank Riboud, the Danone CEO, stated that the company remained in central Paris so the lives of the employees would not be disrupted too much.[21]

Main brands

Mineral water

Evian, Volvic, Badoit[22], Salvetat[23], Aqua, Naya,[2] Lanjarón, Font Vella, Bonafont (Brazil), Villa del Sur, Villa Vicencio.

Food products

Actimel, Activia, Blédina baby food,Crush yogurt, Danone, Dan-ni-no, Danimals, and Royal Numico baby food brands including Cow & Gate and Almiron (Spain), Milupa.

Advanced Medical Nutrition

The acquisition of Royal Numico included SHS International.[24] The brands include Ketocal (for the management of the ketogenic diet, Lophlex LQ (for the management of phenylketonuria, Neocate (for the management of cows milk allergy), and Alicalm (for the management of Crohn's disease).

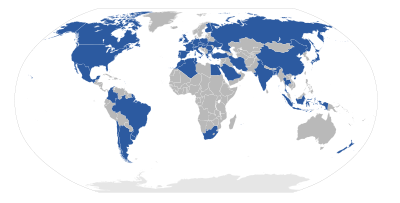

Joint ventures

Danone has adopted a strategy of growth through joint ventures, particularly in fast-growing emerging markets, because it lacked the management depth and size to grow quickly. In its markets, Danone has built an attractive portfolio in emerging markets over the past 10 years which represents 30% of its sales.[25]

Danone has continued to pursue this strategy and has recently signed joint ventures with companies such as Al Safi in Saudi Arabia (2001),[26] Yakult in India (2005) and Vietnam (2006), Alquería in Colombia (2007), and Mengniu in China (2006).[25]

Danone has been having problems with some of its other joint ventures, notably its joint venture with Hangzhou Wahaha Group (1996) and Britannia Biscuits in India (1995), which have been in high-profile disputes since early 2007 and 2006, respectively. Danone filed for arbitration with Britannia Biscuits in the Bombay High Court on 29 June; arbitration with the Wahaha Group was accepted in Hangzhou on 17 June 2007.

India

Under the 1995 joint venture agreement to acquire Britannia Industries, Danone agreed not to launch food brands within India without the consent of the Wadia family.[27] The partners also agreed on a right of first refusal to the other partner in the event of the other wishing to exit.[28]

In light of frustrations with the growth and marketing strategy in India, Danone initiated plans to independently invest in an Indian dairy subsidiary. In May 2007, Nusli Wadia told the Ministry of Commerce and Industry that Danone invested in Avesthagen, a Bangalore-based bio-nutrition company, in October 2006 in violation of the government's Press Note 1, 2005, which requires a foreign company to obtain the consent of its Indian joint venture partner before pursuing an independent business in a similar area, including joint ventures based purely on technical collaboration. Danone argued that Press Note 1 did not apply to it as it did not have a formal technology transfer or trademark agreement with Avesthagen, and that its 25% holding in Britannia was indirect.[29] Wadia also filed a case in the Bombay High Court for a breach of a non-compete clause in the contract. The court ordered Danone not to alienate, encumber, or sell shares of Avestagen.[30]

In September 2007, the Foreign Investment Promotion Board of India rejected Danone's claims that it does not need a non-compete waiver from the Wadias in order to enter into business in India alone.[31]

Israel

In March 1996 Danone signed an agreement to purchase 20 percent of the Strauss Group, Israel's second largest food manufacturer. Under the agreement, Danone purchased about 20% of Strauss Dairies (today Strauss Health division) in Nahariya. Since the 1970s, Strauss Dairies had a series of partnership and knowledge agreements with the Danone Group.[32]

Pakistan

Danone acquired a 49.5% share in Pakistan's Continental Biscuits Limited in 1984. As part of Kraft's takeover of Danone biscuits division, this stake subsequently transferred to Kraft Foods Singapore.

China

Bright Dairy

In 2001, Danone acquired a 5% stake in Bright Dairy and, in March 2005, doubled its shareholding,[33] and again, to 20%, in April 2006, becoming the third largest shareholder after Shanghai Milk Group and S.I. Food, each holding 25.17%.[34] Danone and Bright set up a 50–50 yoghurt joint venture in 1992. Danone licensed Bright Dairy to produce and market products inside China using Danone brands. The joint venture underwent a stake-diversification reshuffle and went public in 2000.[35]

Shortly after increasing its stake, Danone's plans were upset when the Shanghai government announced it was to consolidate the city's food and beverages market by merging Shanghai Bright Dairy Group, the holding company for Bright Dairy, with Shanghai Sugar Tobacco Wine Co., Shanghai Agriculture Industry and Commerce Group and Jinjiang Food. The new conglomerate, named Bright Foods, would be managed by the Shanghai local administration and the State-owned Assets Supervision and Administration Commission.[34]

The parties announced in October 2007 that Danone would divest its stake by selling it to the other two main shareholders at a small profit.[35] Bright Dairy said Danone would pay 330m yuan (€31m) to terminate the existing distribution and production agreement with it.[36]

Wahaha

Main article: Wahaha Joint Venture CompanyThe Hangzhou Wahaha Group, the largest beverage producer in China,[37] and Danone entered into a dairy products joint venture in 1996, in which Danone held 51%. It was hailed by Forbes magazine as a "showcase" joint venture.[38]

As the businesses expanded and became more complex, Danone made several attempts to take a stake in the Wahaha companies external to the joint venture, but was rebuffed by Wahaha's General Manager Zong Qinghou.[39] Danone and Zong Qinghou had signed a deal in December 2006 allowing Danone to buy a majority stake in these non-JV operations. However, Zong had second thoughts about the deal and reneged, claiming the offer was underpriced and held out for a higher price from Danone.[40]

The dispute took on the shape of a trademark dispute, and Danone filed for arbitration in Stockholm on 9 May 2007.[35] On 4 June,[41] Danone filed suit in Los Angeles Superior Court against Ever Maple Trading and Hangzhou Hongsheng Beverage Co Ltd, companies controlled by Zong, his wife, and daughter.[42]

Marketing

- Danone Institute International is a non-profit organisation originally established in 1997 with funding from the company. The Danone International Prize for Nutrition, worth €120,000, is presented biennially to honour individuals or teams that have advanced the science of human nutrition.

- In the 1970s, the company aired a television advertisement entitled "In Soviet Georgia" in the United States over a period of many years.

- Following advertising campaigns for fat-free yoghurt in Spain using the slogan "cuerpo Danone" ("Danone body"), it has become a slang term for a model-like, slender, muscular body[citation needed].

- On 20 April 2009, Danone opened its first-ever retail operation, a 300 square meter restaurant / store / small museum, in Barcelona, Spain.[43]

Danone Business Game: Trust

"TRUST" is an international business game organised by Groupe Danone and its subsidiaries. The business game is a way to for Danone to identify and recruit possible future employees, that fit the companies values and way of doing business and furthermore enables Danone to improve its “employer image”. Students participating in the game have to deal with different aspects of the business life whilst running a strategy of a fictive Danone company, on both business and sustainable development aspects. Problem solving skills, analytical skills and resourcefulness are all put to test.

The game consists of three main stages:

- First step of the game: TRUST day: In each participating country students have to set up a 3-year strategy for a fictive subsidiary of Danone. (business and stakeholders’ trust goals)

- Second step, National final: Students present their business plan to a group of Danone directors from their country. Teams are evaluated and the best one wins a trip to Paris to run the international final.

- Last stage, in Paris. During the International Final in Paris, each national finalist competes against each other.

Danone International Prize for Nutrition

The Danone International Prize for Nutrition is an award established in 1997 and presented every two years to honour individuals or teams that have advanced the science of human nutrition.

It is promoted by the Danone Institute International and offers a prize of €120,000.

Danone Institute International is a non-profit organisation originally established with funding from Groupe Danone.

Prize winners

- 2007 Jeffrey M. Friedman, Rockefeller University and Howard Hughes Medical Institute; for research on the role of genetics and leptin, a hormone he discovered, in body-weight regulation.[44]

- 2005 David J. P. Barker, epidemiologist at the Developmental Origins of Health and Disease Division Research Centre of Southampton University, UK and at the Heart Research Centre, Oregon Health and Science University, USA.

- 2003 Ricardo Bressani

- 2001 Alfred Sommer and team from the School of Hygiene and Public Health at Johns Hopkins University

- 1999 Leif Hallberg

- 1997 Vernon R. Young

See also

- List of French companies

- Yoplait, another popular yoghurt brand.

References

- Neil R. Gazel, Beatrice: From Buildup Through Breakup. University of Illinois Press, 1990. ISBN 0-252-01729-3. Discusses the early history of Dannon in the US on pages 30ff.

On-line references

- ^ a b c d e f "Annual Report 2010" (PDF). Danone. http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9MzEyNTB8Q2hpbGRJRD0tMXxUeXBlPTM=&t=1. Retrieved 16 April 2011.

- ^ a b c "Fresh dairy products: our brands". Danone Group. http://www.danone.com/en/brands/business/fresh-dairy-products.html. Retrieved 21 September 2008.

- ^ a b "Danone mulls Kraft biscuit deal". BBC News. 3 July 2007. http://news.bbc.co.uk/1/hi/business/6264318.stm. Retrieved 9 July 2007.

- ^ "Annual Report 2006" (PDF). Danone. http://library.corporate-ir.net/library/95/951/95168/items/258892/AnnualReport2006.pdf. Retrieved 12 July 2008.

- ^ "History of Success: from bottles to beverages". Danone Group. http://www.danone.com/wps/portal/jump/DanoneCorporateIntl.Company.History.1966_1980. Retrieved 11 April 2007.

- ^ a b "Setting out to conquer Europe". Danone Group. http://www.danone.com/wps/portal/!ut/p/kcxml/04_Sj9SPykssy0xPLMnMz0vM0Y_QjzKLN4h3CgHJgFiWvvqRqCLGpugijnCBoLQifW99X4_83FT9AP2C3NDQiHJHRQC2okxl/delta/base64xml/L3dJdyEvd0ZNQUFzQUMvNElVRS82XzBfTjY!. Retrieved 11 April 2007.

- ^ "Scottish & Newcastle acquires Kronenbourg in £1.7bn deal". The Independent (UK). http://www.findarticles.com/p/articles/mi_qn4158/is_20000321/ai_n14283654. Retrieved 12 April 2007.[dead link]

- ^ a b "European Buy-Outs: Italy’s many privately owned businesses are welcoming private equity as a way to drive consolidation". Real Deals. 26 January 2006. http://www.realdeals.eu.com/Article.aspx?ArticleID=38412. Retrieved 12 April 2007.[dead link]

- ^ "Danone sells its UK biscuits to United". The Independent (UK). 24 July 2004. http://www.findarticles.com/p/articles/mi_qn4158/is_20040724/ai_n12801313. Retrieved 12 April 2007.[dead link]

- ^ "Annual Report on Form 20-F". Danone Group. http://edgar.sec.gov/Archives/edgar/data/1048515/000119312507071783/d20f.htm. Retrieved 11 April 2007.

- ^ "Danone to Offer 12.3 Billion Euros for Numico". CNBC. 9 July 2007. Archived from the original on 30 September 2007. http://web.archive.org/web/20070930181722/http://www.cnbc.com/id/19676778. Retrieved 9 July 2007.

- ^ "PepsiCo ne lance pas d'OPA sur Danone". Associated Press. 25 July 2005. http://www.boursorama.com/infos/actualites/detail_actu_marches.phtml?news=2820131. Retrieved 11 April 2007.(French)

- ^ "La France veut mieux protéger ses entreprises face aux OPA". Associated Press. Boursorama. 27 March 2007. http://www.boursorama.com/infos/actualites/detail_actu_marches.phtml?news=2955010. Retrieved 11 April 2007.(French)

- ^ "Le gouvernement interdira le rachat de groupes français dans les secteurs stratégiques". Associated Press. Boursorama. 29 August 2005. http://www.boursorama.com/infos/actualites/detail_actu_marches.phtml?news=2907164. Retrieved 11 April 2007.(French)

- ^ David Rothnie, US companies may bid for Danone division, Financial News, 28 Jun 2007

- ^ "Pepsico travaille sur des projets de croissance externe en France". AOF. Boursorama. 21 July 2006. http://www.boursorama.com/infos/actualites/detail_actu_societes.phtml?news=3568486. Retrieved 11 April 2007.(French)

- ^ "Danone: Reprise des spéculations un an après les rumeurs PepsiCo". Associated Press. 23 June 2006. http://www.boursorama.com/infos/actualites/detail_actu_societes.phtml?news=3515970. Retrieved 11 April 2007.(French)

- ^ "Eschewing Snacks, Danone Goes for Baby Food". Forbes. 9 July 2007. http://www.forbes.com/markets/2007/07/09/numico-shares-update-markets-equity-cx_ll_0709markets25.html. Retrieved 9 July 2007.

- ^ "Contacts." Groupe Danone. Retrieved on 23 March 2010.

- ^ "Danone Group's addresses." Groupe Danone. Retrieved on 26 July 2010.

- ^ a b "Danone : regrouper les salariés dans un même bâtiment." Le Journal du Net. Retrieved on 26 July 2010.

- ^ http://www.badoit.fr/

- ^ http://www.lasalvetat.fr/

- ^ SHS International, [1] SHS International History,

- ^ a b James T. Areddy & Deborah Ball, Danone's China Strategy Is Set Back, Wall Street Journal, Page A10, 15 June 2007

- ^ Al Safi Danone History

- ^ Ruth David, Danone's Indian Cookie JV Set To Snap, Forbes, 25 June 2007

- ^ Danone may dissolve ties with Britannia, IRIS NEWS DIGEST, 21 June 2007, Retrieved 18 July 2007

- ^ Danone denies JV with India's Britannia; to proceed with solo plans – report, Thomson Financial, 25 May 2007

- ^ Wadias take Danone to court, 5 December 2006

- ^ Danone needs NOC from Wadias: FIPB, 28 September 2007

- ^ Beck, Galit Lipkis (5 March 1996), "France's Danone to buy 20% of Strauss Dairies", Jerusalem Post, http://www.highbeam.com/doc/1P1-2433191.html, retrieved 27 May 2010

- ^ Danone to double Bright Dairy stake, People's Daily, 4 March 2005

- ^ a b Vivian Wai-yin Kwok, Danone Sells Out Of Bright Dairy, Forbes, 16 October 2007

- ^ a b c Xinhua, "Partnership ends as China's Bright Dairy confirms Danone's stake sale", Sina.com, 16 October 2007, retrieved 18 October 2007

- ^ Neil Merrett, Danone sells Chinese dairy stake, Dairy Reporter, 17 October 2007

- ^ "Danone set to sue Wahaha over breach of contract". South China Morning Post (Hong Kong): p. B3. 11 April 2007.

- ^ Elaine Kurtenbach (27 June 2007). "Wahaha-Danone Feud Highlights Pitfalls". Forbes. http://www.forbes.com/feeds/ap/2007/06/27/ap3861182.html. Retrieved 17 July 2007.[dead link]

- ^ "Danone and Wahaha vie for the last laugh". South China Morning Post (Hong Kong): p. B3. 11 June 2007.

- ^ 签约与悔约(regrets) Wahaha – atypical commercial dispute, Caijing Issue 185, 14 May 2007 (Chinese)

- ^ "current developments regarding Wahaha dispute" (Press release). Danone Group. 12 June 2007. http://www.danone.com/wps/portal/jump/DanoneCorporateIntl.Press.Commun2004PressReleases?ref=CMS.DanoneCorporateIntl.Press.2006PressReleases.Trimestre1.CP_120607. Retrieved 21 June 2007.

- ^ Danone, Wahaha set for arbitration dispute in China, Agence France-Presse story, France24, 18 June 2007

- ^ "Noticia economia: Empresas Danone abre Barcelona primer local gran publico venta directa restaurante". Europapress.es. http://www.europapress.es/economia/noticia-economia-empresas-danone-abre-barcelona-primer-local-gran-publico-venta-directa-restaurante-20090420140735.html.

- ^ Rockefeller University: "Obesity researcher awarded Danone nutrition prize"

External links

Bruno Bonnell · Richard Goblet d'Alviella · Michel David-Weill · Emmanuel Faber · Jean Laurent · Hirokatsu Hirano · Bernard Hours · Christian Lauble · Hakan Mogren · Jacques Nahmlas · Benoît Potier · Franck Riboud · Jacques VincentProducts:  CAC 40 companies of France

CAC 40 companies of FranceAccor · Air Liquide · Alcatel-Lucent · Alstom · ArcelorMittal · AXA · BNP Paribas · Bouygues · Capgemini · Carrefour · Crédit Agricole · EADS · EDF · Essilor · France Télécom · GDF Suez · Groupe Danone · L'Oréal · Lafarge · LVMH · Michelin · Pernod Ricard · PSA Peugeot Citroën · PPR · Publicis · Renault · Safran · Saint-Gobain · Sanofi · Schneider Electric · Société Générale · STMicroelectronics · Suez Environnement · Technip · Total · Unibail-Rodamco · Vallourec · Veolia Environnement · VINCI · Vivendi

Categories:- Companies listed on the Euronext exchanges

- Companies listed on the OTC Bulletin Board

- CAC 40 companies

- Companies of France

- French brands

- Food manufacturers of France

- Dairy products companies of France

- Multinational food companies

- Groupe Danone brands

- Companies established in 1919

- Dairy products companies of the United States

- Brand name yoghurts

Wikimedia Foundation. 2010.