- War bond

-

War bonds are debt securities issued by a government for the purpose of financing military operations during times of war. War bonds generate capital for the government and make civilians feel involved in their national militaries. This system is also useful as a means of controlling inflation in such an overstimulated economy by removing money from circulation until hopefully after the war is concluded. At that point, the funds could be liquidated and serve as a stimulus to encourage consumer spending for the economy transitioning to peacetime activity. Exhortations to buy war bonds are often accompanied with appeals to patriotism and conscience. Government-issued war bonds tend to have a yield which is below market value and are often made available in a wide range of denominations to make them affordable to all citizens.

Contents

American Civil War

War bonds were issued by both the Union and Confederate governments during the American Civil War in order to raise funds for the war effort. 62% of the Union's war effort was financed by war bonds.(Source: Why the North Won the Civil War by David Herbert Donald) [1][2]

World War I

Austria-Hungary

The government of Austria-Hungary knew from the early days of the First World War that it could not count on advances from its principal banking institutions to meet the growing costs of the war. Instead, it implemented a war finance policy modeled upon that of Germany:[3] in November 1914, the first funded loan was issued.[4] As in Germany, the Austro-Hungarian loans followed a prearranged plan and were issued at half yearly intervals every November and May. The first Austrian bonds had five percent rates of return and a five year maturity. The smallest bond denomination available was 100 kronen.[4]

Hungary issued loans separately from Austria in 1919, in the form of stocks that permitted the subscriber to demand repayment after a year's notice. Interest was fixed at six percent, and the smallest denomination was 50 kronen.[4] Subscriptions to the first Austrian bond issue amounted to the equivalent of $440,200,000; those of the first Hungarian issue were equivalent to $235,000,000.[4]

The limited financial resources of children were tapped through campaigns in schools. The initial minimum Austrian bond denomination of 100 kronen still exceeded the means of most children,[5] so the third bond issue, in 1915, introduced a scheme whereby children could donate a small amount and take out a bank loan to cover the rest of the 100 kronen.[5] The initiative was immensely successful, eliciting funds and encouraging loyalty to the state and its future among Austro-Hungarian youth.[5] Over 13 million kronen was collected in the first three "child bond" issues.[5]

Canada

Main article: Victory war bondCanada's involvement in the First World War began in 1914, with Canadian war bonds called "Victory Bonds" after 1917.[6] The first domestic war loan was raised in November 1915, but not until the fourth campaign of November 1917 was the term Victory Loan applied. The First Victory Loan was a 5.5% issue of 5, 10 and 20 year gold bonds (some as small as $50) and was quickly oversubscribed, collecting $398 million or about $50 per capita. The Second and Third Victory Loans were floated in 1918 and 1919, bringing another $1.34 billion.[7] For those who could not afford to buy Victory Bonds, the government also issued War Savings Certificates.

Germany

Unlike France and Britain, at the outbreak of the First World War Germany found itself largely excluded from international financial markets.[8] This became most apparent after an attempt to float a major loan on Wall Street failed in 1914.[8] As such, Germany was largely limited to domestic borrowing, which was induced by a series of war credit bills passing the Reichstag.[9] This took place in many forms however the most publicized was the public war bond drives (Kriegsanleihe).[8]

Nine bond drives were conducted over the length of the war and, as in Austria-Hungary, the loans were issued at six month intervals. The drives themselves would often last several weeks and during which there was extensive use of propaganda via all possible mediums.[10] Most bonds had a rate of return of 5 percent and were redeemable over a ten year period, in semi-annual payments.[8] Like war bonds in other countries, the German war bonds drives were designed to be extravagant displays of patriotism and were sold through banks, post offices and other financial institutions.[8]

Like in other countries, the majority investors were not individuals but institutions and large corporations.[11] Industries, university endowments, local banks and even city governments were the prime investors in the war bonds.[11] In part because of intense public pressure and in part due to patriotic commitment the bond drives proved extremely successful, raising approximately 100 billion marks in funds.[12] Although extremely successful the war bond drives only covered two-thirds of the war related expenditures.[12] Meanwhile, the interest on the bonds represented an accumulating expense which claimed further resources.[12]

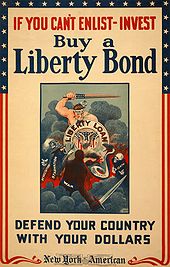

United States

In 1917 and 1918, the United States government issued liberty bonds to raise money for its involvement in World War I. An aggressive campaign was created by Secretary of the Treasury William Gibbs McAdoo to popularize the bonds, grounded largely as patriotic appeals.[13] The Treasury Department worked closely with the Committee on Public Information in developing Liberty Bond campaigns.[14] The resulting propaganda messages often borrowed heavily from military colloquial speech.[14]

The government used famous artists to make posters, and used movie stars to host bond rallies. Al Jolson, Elsie Janis, Mary Pickford, Douglas Fairbanks and Charlie Chaplin were among the celebrities that made public appearances promoting the patriotic element of purchasing Liberty Bonds.[15] Chaplin also made a short film, The Bond, at his own expense for the drive.[16] Even the Boy Scouts and Girl Scouts sold bonds under the slogan "Every Scout to Save a Soldier". The campaign spurred community efforts across the country to sell the bonds and was a great success resulting in over-subscriptions to the second, third and fourth bond issues.[17] According to the Massachusetts Historical Society, "Because the first World War cost the federal government more than 30 billion dollars (by way of comparison, total federal expenditures in 1913 were only $970 million), these programs became vital as a way to raise funds."[18]

Through the selling of Liberty Bonds, the government raised $21.5 billion for the war effort.[14] However, the majority sales were not to individuals but to banks and financial groups that ignored the patriotic appeal and sought the bonds as principally an investment opportunity.[14] The bond campaigns themselves proved relatively ineffective at gaining widespread public support. The majority of Americans were simply uncomfortable converting a significant portion of their savings into, what was for them, a new and uncertain form of investment.[14] The forceful sales atmosphere associated with the Liberty Bond campaigns ultimately produced disappointing sales figures. As such, the bond campaigns are remembered more for their associated level of coercion and bullying than its patriotic and voluntary nature.[19] Secretary of the Treasury Henry Morgenthau, Jr. would face a balancing act between coercion and volunteerism in his bond campaigns during World War II.[19]

World War II

United States

By the summer of 1940, the victories of Nazi Germany against Poland, Denmark, Norway, Belgium, the Netherlands and France brought urgency to the government discreetly preparing for possible United States involvement in World War II.[20] Of principal concern were issues surrounding war financing. Many of President Franklin D. Roosevelt's advisers favored a system of tax increases and enforced savings program as advocated by British economist John Maynard Keynes.[20] In theory, this would permit increased spending while decreasing the risk of inflation.[20] Secretary of the Treasury Henry Morgenthau, Jr. however preferred a voluntary loan system and began planning a national defense bond program in the fall of 1940. The intent was to unite the attractiveness of the baby bonds that had been implemented in the interwar period with the patriotic element of the Liberty Bonds from the First World War.[21]

Cover of the August 1943 issue of the 4 Favorites showing "War Bond" beating Hirohito, Adolf Hitler and Benito Mussolini.

Cover of the August 1943 issue of the 4 Favorites showing "War Bond" beating Hirohito, Adolf Hitler and Benito Mussolini.

Morgenthau sought the aid of Peter Odegard, a political scientist specialized in propaganda, in drawing up the goals for the bond program.[22] On the advice of Odegard the Treasury began marketing the previously successful baby bonds as "defense bonds".[22] Three new series of bond notes, Series E, F and G, would be introduced, of which Series E would be targeted at individuals as "defense bonds".[22] Like the baby bonds, they were sold for as little as $18.75 and matured in ten years, at which time the United States government paid the bondholder $25[22] Large denominations of between $50 and $1000 were also made available, all of which, unlike the Liberty Bonds of the First World War, were non-negotiable bonds.[22] For those that found it difficult to purchase an entire bond at once, 10 cent savings stamps could be purchased and collected in Treasury approved stamp albums until the recipient had accumulated enough stamps for a bond purchase.[23] The name of the bonds was eventually changed to War Bonds after the Japanese attack on Pearl Harbor on 7 December 1941, which resulted in the United States entering the war.

The War Finance Committee was placed in charge of supervising the sale of all bonds, and the War Advertising Council promoted voluntary compliance with bond buying. Popular contemporary art was used to help promote the bonds. More than a quarter of a billion dollars worth of advertising was donated during the first three years of the National Defense Savings Program. The government appealed to the public through popular culture. Norman Rockwell's painting series, the Four Freedoms, toured in a war bond effort that raised $132 million.[24][25] Bond rallies were held throughout the country with famous celebrities, usually Hollywood film stars, to enhance the bond advertising effectiveness. The Music Publishers Protective Association encouraged its members to include patriotic messages on the front of their sheet music like "Buy U.S. Bonds and Stamps". Over the course of the war 85 million Americans purchased bonds totalling approximately $185.7 billion.

The National Service Board for Religious Objectors offered civilian bonds in the United States during World War II, primarily to members of the historic peace churches as an alternative for those who could not conscientiously buy something meant to support the war. These were U.S. Government Bonds not labelled as defence bonds. In all, 33,006 subscriptions were sold for a total value of $6,740,161, mostly to Mennonites, Brethren and Quakers.[26][27]

Canada

Canada's involvement in the Second World War began when Canada declared war on Nazi Germany on September 10, 1939, one week after the United Kingdom. Approximately half of the Canadian war cost was covered by War Savings Certificates and war bonds known as "Victory Bonds" as in WWI.[28] War Savings Certificates began selling in May 1940 and were sold door-to-door by volunteers as well as at banks, post offices, trust companies and other authorized dealers.[28] They matured after seven years and paid $5 for every $4 invested but individuals could not own more than $600 each in certificates. Although the effort raised $318 million in funds and was successful in financially involving millions of Canadians in the war effort, it only provided the Government of Canada with a fraction of what was needed.[28]

The sale of Victory Bonds proved far more successful financially. There were ten wartime and one postwar Victory Bond drives. Unlike the War Savings Certificates, there was no purchase limit to Victory Bonds.[28] The bonds were issued with maturities of between six and fourteen years with interest rates ranging from 1.5 percent for short-term bonds and 3 percent for long-term bonds and were issued in denominations of between $50 and $100,000.[28] Canadians bought $12.5 billion worth of Victory Bonds or some $550 per capita with businesses accounting for half of all Victory Bond sales.[28] The first Victory Bond issue in February 1940 met its goal of $200 million in less than 48 hours, the second issue in September 1940 reaching its goal of $300 million almost as quickly.[29]

When it became apparent that the war would last a number of years the war bond and certificate programs were organized more formally under the National War Finance Committee in December 1941, directed initially by the president of the Bank of Montreal and subsequently by the Governor of the Bank of Canada.[29] Under the more honed direction the committee developed strategies, propaganda and the wide recruitment of volunteers for bonds drives. Bond drives took place every six months during which no other organization was permitted to solicit the public for money.[29] The government spent over $30 million on marketing which employed posters, direct mailing, movie trailers, radio commercials and full page advertisement in most major daily newspaper and weekly magazine.[30] Realistic staged military invasion, such as the If Day scenario in Winnipeg, Manitoba, were even employed to raise awareness and shock citizens into purchasing bonds.[31]

Germany

The Nazi regime never attempted to convince the general populace to buy long-term war bonds as had been done during the First World War.[32] The Reich government did not want to present any perceived form of public referendum on the war, which would be the indirect result if a bond drive did poorly.[33] Rather, the regime financed its war efforts by borrowing directly from financial institutions, using short-term war bonds as collateral.[32] German bankers, with no demonstration of resistance, agreed to taking state bonds into their portfolios.[32] Financial institutions transferred their money to the Finance Department in exchange for promissory notes. Through this strategy, 40 million bank and investment accounts were quietly converted into war bonds, providing the Reich government with a continuous supply of money.[34] Likewise, German bank commissioners compelled occupied Czechoslovakia to buy up German war bonds. By the end of the war, German war bonds accounted for 70 percent of investments held by Czechoslovakian banks.[34]

United Kingdom

In the United Kingdom, the National Savings Movement was instrumental in raising funds for the war effort during both world wars. During World War II a War Savings Campaign was set up by the War Office to support the war effort. Local savings weeks were held which were promoted with posters with titles such as "Lend to Defend the Right to be Free", "Save your way to Victory" and "War Savings are Warships".

Notes

- ^ "1861-1865: The Civil War". TaxHistory.org. http://www.taxhistory.org/www/website.nsf/Web/THM1861?OpenDocument. Retrieved 2011-05-27.

- ^ Heidler, David (2002). Encyclopedia of the American Civil War. W.W. Norton & Company. p. 692. ISBN 039304758X.

- ^ Bogart, p. 240

- ^ a b c d Bogart, p. 239

- ^ a b c d Healy, p. 244

- ^ "CBC News In Depth: Canada Savings Bonds". CBC. 2007-10-03. http://www.cbc.ca/news/background/canada-savings-bonds/. Retrieved 2010-08-16.

- ^ Hillier, Norman. "Victory Loans". The Canadian Encyclopedia. Historica-Dominion. http://www.thecanadianencyclopedia.com/index.cfm?PgNm=TCE&Params=A1ARTA0008364. Retrieved 2009-12-12.

- ^ a b c d e Chickering (2004), p. 104

- ^ "Reichstag Receives $2,856,000,000 Bill". The New York Times. 1916-10-28. http://query.nytimes.com/mem/archive-free/pdf?res=F20715FF385B17738DDDAD0894D0405B858DF1D3. Retrieved 2011-07-12.

- ^ Chickering (2007), p. 196

- ^ a b Chickering (2007), p. 198

- ^ a b c Chickering (2004), p. 105

- ^ Kimble, p.15

- ^ a b c d e Kimble, p.16

- ^ Gale Encyclopedia of U.S. Economic History

- ^ Chaplin, Charlie (1964). My Autobiography.

- ^ New York Times, March 27, 1918, page 4.

- ^ "Focus on: Women and War". Massachusetts Historical Society. 2002. Archived from the original on 2006-05-20. http://web.archive.org/web/20060520153713/http://www.masshist.org/cabinet/june2002/stamps.htm. Retrieved 2006-10-18.

- ^ a b Kimble, p.17

- ^ a b c Kimble, p. 19

- ^ Kimble, p. 20

- ^ a b c d e Kimble, p. 23

- ^ Kimble, p. 24

- ^ "Michener Art Museum Pairs Famed American Illustrators Rockwell and Hargens for Fall Exhibitions in New Hope" (Press release). The James A. Michener Art Museum. 2007-08-08. http://www.michenermuseum.org/press/?item=2007-08-08. Retrieved 2008-04-05.

- ^ Saturday Evening Post, March 20, 1943, Vol. 215 Issue 38, p. 4-4, 1/5p; (AN 18990616).

- ^ Gingerich, Melvin (1949). Service for Peace, A History of Mennonite Civilian Public Service. Akron, Pa.: Mennonite Central Committee. pp. 355–358. OCLC 1247191.

- ^ bonds

- ^ a b c d e f Keshen, p. 31

- ^ a b c Keshen, p. 32

- ^ Keshen, p.33

- ^ Keshen, p. 34

- ^ a b c Aly & Chase, p. 294

- ^ Aly & Chase, p. 298

- ^ a b Aly & Chase, p. 295

References

- Address of President Franklin D. Roosevelt in connection with the opening of the fifth war loan drive. 2009. Essential Speeches.

- Aly, Götz; Chase, Jefferson (2007). Hitler's beneficiaries: plunder, racial war, and the Nazi welfare state. New York: Macmillan. ISBN 0805079262.

- Bird, William L. Jr; Rubenstein, Harry R. (1998). Design for victory : World War II posters on the American home front. New York, NY: Princeton Architectural Press.

- Bogart, Ernest Ludlow (1919). David Kinley. ed. Direct and Indirect Costs of the Great World War (2nd ed.). Vancouver: Oxford University Press. ISBN 077480923X.

- Chickering, Roger (2004). Imperial Germany and the Great War, 1914-1918 (2nd ed.). Cambridge: Cambridge University Press. ISBN 0521547806.

- Chickering, Roger (2007). The Great War and urban life in Germany: Freiburg, 1914-1918. Cambridge: Cambridge University Press. ISBN 0521852560.

- Keshen, Jeff (2004). Saints, sinners, and soldiers: Canada's Second World War. Vancouver: UBC Press. ISBN 077480923X.

- Kimble, James J. (2006). Mobilizing the home front: war bonds and domestic propaganda. Dallas: Texas A&M University Press. ISBN 1585444855.

- Sparrow, J.T. (2008). "Buying our boys back": The mass foundations of fiscal citizenship in World War II. Journal of Policy History, 20(2), 263-286.

- Streib, G.F. (1948). Idealism and war bonds: Comparative study of the two world wars. Oxford Journals,Public Opinion Quarterly 12, 272-279.

- Unknown (2003). Journal of Advertising: Volume 32, number 1/spring 2003 pages: 69-82.

External links

Categories:- Government finances

- Military terminology

- Government bonds

Wikimedia Foundation. 2010.