- CPA Australia

-

CPA Australia

Industry Accounting and Finance Founded Melbourne [Victoria, Australia]  (1886 as IIAV)

(1886 as IIAV)Head Office Melbourne, Australia

Locations Australia, Europe, Hong Kong, Beijing, Shanghai, Malaysia, New Zealand, Singapore, Vietnam Areas served Global President John Cahill FCPA (Oct 2011 -) CEO Alex Malley Members 132,000 Member's Designations CPA & FCPA Website www.cpaaustralia.com.au CPA Australia is one of three professional accounting bodies in Australia, the others being the Institute of Public Accountants and the Institute of Chartered Accountants of Australia.

CPA Australia is one of the largest global accounting bodies, having members through Asia Pacific as well as its home base.

Contents

History

The name CPA Australia dates from April 2000.[1] Prior to that, the society had been known as the Australian Society of Certified Practising Accountants since July 1990. In its current form the society dates from 1952 when it was incorporated as the Australian Society of Accountants. The main predecessor bodies of the Society, with year of formation, are:

- Incorporated Institute of Accountants, 1886 (changed name in 1921 to the Commonwealth Institute of Accountants)

- Federal Institute of Accountants, 1894

- Association of Accountants of Australia, 1910

- Australian Institute of Cost Accountants, circa 1925

In 1952, the Commonwealth Institute and Federal Institute merged to form the Society. The Association of Accountants of Australia was merged into the Society some years later, with the Australian Institute of Cost Accountants following in 1966.

Membership

CPA Australia building in Canberra.

CPA Australia building in Canberra.

CPA Program consists of 14 education segments and a fully integrated practical experience requirement. The educational component of CPA Program has two parts: the foundation level and the professional level.

To be a CPA, candidates must hold a degree or a postgraduate award recognised by CPA Australia, have demonstrated competence in CPA Australia’s prescribed foundation level knowledge and with in a six-year period have successfully completed CPA Australia’s professional level examinations and the Practical Experience Requirement.

The foundation level represents the first eight exams (segments) of CPA Program, and each designed to assess technical knowledge gained through work experience or study to ensure candidates are ready to undertake the professional level of CPA Program. The completion of an accredited or recognised degree, such as an accounting degree, will often meet all the requirements of the Foundation level and allow candidates to commence at the professional level.

The professional level is made up of six post-graduate education segments and builds on this strong foundation with higher level analysis, judgment, decision making and reporting and focuses on areas that ensure a CPA is valued by any employer - ethics, governance, leadership and strategy.

The three year practical experience requirement, part of the professional level of CPA Program, has been designed in response to the needs of different stakeholders including employers, industry and graduates. The practical experience requirement develops candidates technical, business, personal effectiveness and leadership skills.

Candidates entry point into CPA Program will be determined by an individual assessment of prior education and experience. The completion of an accredited or recognised degree, such as an accounting degree, will often meet all the requirements of the foundation level and allow you to commence at the professional level.

Compulsory CPD applies to all ASA, CPA and FCPA members, including retired members who provide public accounting services, in any year (whether or not this is for reward). Upon renewing membership each year members are required to declare their ongoing compliance with the CPA Australia constitution, by-laws and minimum continuing professional development (CPD) requirements. Fulfilment of 120 Continuing Professional Development (CPD) hours per triennium (3-year period) with a minimum of 20 CPD hours in each year is required for continued membership. Members must monitor their own CPD hours and CPA Australia also conducts random audits of members to confirm that they are meeting the CPD requirements.

Full members of CPA Australia use the designatory letters CPA, (CPA (Aust.) in Hong Kong). Senior members may become Fellows and use the letters FCPA, (FCPA (Aust.) in Hong Kong).

CPA Australia has approximately 132,000 members (CPA/FCPA/ASA).[2] An increasing proportion of these members are from other countries or Australians located overseas.

Skill assessment

CPA Australia is gazetted by the Department of Immigration and Citizenship (DIAC) to assess qualification for overseas qualified accountants seeking immigration to Australia under the following Australian standard classification of occupations (ASCO) codes[3]:

- accountants (ASCO code 2211-11)

- accountant, corporate treasurers (ASCO code 2213-11)

- accountant, external auditors (ASCO code 2212-11)

- finance managers (ASCO code 1211-11)

Related organisations

In the Australian regulatory framework, CPA Australia, the Institute of Chartered Accountants of Australia and the Institute of Public Accountants co-operate in an advisory role in formulating and interpreting accounting standards. All three bodies co-operate closely on professional matters, and issue joint handbooks. There was some discussion about merging the membership of both bodies, but there are no concrete plans for this move. Such a move would likely be considered controversial given the different entry requirements of each organisation.[citation needed] The three bodies collaborate in supporting the Accounting Professional & Ethical Standards Board, founded in 2006, which publishes ethics-related standards for accountants in Australia based on the international standards published by the International Ethics Standards Board for Accountants (IESBA).[4][5]

Mutual recognition

CPA Australia has mutual recognition agreements with the:[6]

- Society of Management Accountants of Canada (CMA Canada)

- Certified General Accountants Association of Canada (CGA-Canada)

- Hong Kong Institute of Certified Public Accountants (HKICPA)

- Malaysian Institute of Accountants (MIA)

- Institute of Certified Public Accountants of Singapore (ICPAS)

- Chartered Institute of Public Finance and Accountancy (CIPFA)

- Chartered Institute of Management Accountants (CIMA)

- The Institute of Certified Public Accountants in Ireland (CPA Ireland)

- Institute of Chartered Accountants of India (ICAI)

University affiliation

CPA Australia works closely with Australian universities and is a sponsor of the following student accounting organisations:

- The Business Students Association (Bond University)

- University of Queensland Management Association (University of Queensland)

- Financial Management Association (University of Melbourne)

- The Accountancy Students Association (Queensland University of Technology)

- Student Accounting Association (Griffith University)

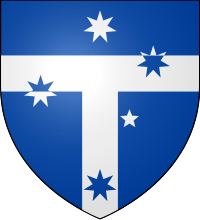

Arms

Arms of CPA AustraliaNotes The arms of CPA Australia consist of:[7]

Crest On a Wreath of the colours, five books erect proper.Escutcheon Azure, a Fess enhanced and in base a Pale Argent, over all a representation of the Southern Cross counterchanged.Motto IntegritySymbolism The T formed by the fess and pale represents a double-sided account, and thus double entry book-keeping.See also

References

- ^ CPA Australia Handbook, 1995, p11021

- ^ About CPA Australia

- ^ Migration Assessment

- ^ "About APESB". APESB. http://www.apesb.org.au/apesb-content/47/about-us. Retrieved 2011-06-08.

- ^ "APESB at a Glance". APESB. http://www.apesb.org.au/apesb-content/48/APESB-at-a-Glance. Retrieved 2011-06-08.

- ^ CPA Australia International Recognition

- ^ Low, Charles (1971). A Roll of Australian Arms. Adelaide: Rigby Limited. pp. 9. ISBN 0 85179 149 2.

External links

- CPA Australia's website

- CPA Australia's student website

- CPA Australia - Global Financial Crisis site

- Now Boarding – CPA Program

- CPA Australia President's Blog - Richard Petty

- YouTube Channel

- Twitter Page

- Facebook Page

- CPA Australia Congress Centre – Second Life

- IFACnet

- Flickr page

IFAC Member Bodies and Associates Asia Africa Europe North America & Caribbean Oceania South America Categories:- Member bodies of the International Federation of Accountants

- Accounting in Australia

- Professional accountancy bodies

Wikimedia Foundation. 2010.