- Debt-to-GDP ratio

-

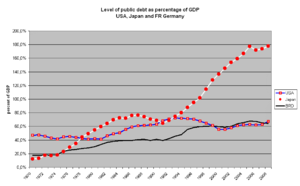

General government debt in percent of GDP, USA, Japan, Federal Republic of Germany.[citation needed]

In economics, the debt-to-GDP ratio is one of the indicators of the health of an economy. It is the amount of national debt of a country as a percentage of its Gross Domestic Product (GDP). A low debt-to-GDP ratio indicates an economy that produces a large number of goods and services and probably profits that are high enough to pay back debts. Governments aim for low debt-to-GDP ratios and can stand-up to the risks involved by increasing debt as their economies have a higher GDP and profit margin. According to the CIA World Factbook, the 2010 public debt-to-GDP ratio in the US was 62.3% with a gross debt-to-GDP ratio of about 92.3%. [1] The level of public debt in Japan in 2010 was 225.8% of GDP. [2] The level of public debt in Germany in the same year was 78.8% of GDP. [3]

Particularly in macroeconomics, various debt-to-GDP ratios can be calculated. The most commonly used ratio is the Government debt divided by the Gross Domestic Product (GDP), which reflects the government's finances, while another common ratio is the total debt to GDP, which reflects the finances of the nation as a whole.

Contents

Units

The debt-to-GDP ratio is generally expressed as a percentage, but properly, has units of years, as below.

By dimensional analysis these quantities are the ratio of a stock (with dimensions of Currency) by a flow (with dimensions of Currency/Time), so[note 1] they have dimensions of Time. With currency units of US Dollars (or any other currency) and time units of years (GDP per annum), this yields the ratio as having units of years, which can be interpreted as "the number of years to pay off debt, if all of GDP is devoted to debt repayment".

This interpretation must be tempered by the understanding that GDP cannot be all devoted to debt repayment — some must be spent on survival, at the minimum, and in general only 5–10% will be devoted to debt repayment, even during episodes such as the Great Depression, which have been interpreted as debt-deflation — and thus actual "years to repay" is debt-to-GDP divided by "fraction of GDP devoted to repayment", which will generally be 10 times as long or more than simple debt-to-GDP.

Changes

The change in debt-to-GDP is approximately "net increase or (decrease) in debt as percentage of GDP"; for government debt, this is deficit or (surplus) as percentage of GDP.

This is only approximate, as GDP changes from year to year, but generally year-on-year GDP changes are small (say, 3%), and thus this is approximately correct.

However, in the presence of significant inflation, deflation, or particularly hyperinflation, GDP may increase rapidly in nominal terms; if debt is nominal, then it will decrease rapidly.

Applications

Debt-to-GDP measures the financial leverage of an economy; some economists, such as Steve Keen, advocate using it as the key measure of a credit bubble (both its level and its change – particularly of private debt and total debt), and high levels of government debt (public debt) are widely decried as fiscal irresponsibility.

One of the Euro convergence criteria was that government debt-to-GDP be below 60%.

World Bank and IMF hold that “a country can be said to achieve external debt sustainability if it can meet its current and future external debt service obligations in full, without recourse to debt rescheduling or the accumulation of arrears and without compromising growth.” According to these two institutions, external debt sustainability can be obtained by a country “by bringing the net present value (NPV) of external public debt down to about 150 percent of a country’s exports or 250 percent of a country’s revenues.” [1] High external debt is believed to have harmful effects on an economy.[4]

There is difference between external debt nominated in domestic currency, and external debt nominated in foreign currency. A nation can service external debt nominated in domestic currency by tax revenues, but to service foreign currency debt it has to convert tax revenues in foreign exchange market to foreign currency, which puts downward pressure on the value of its currency. So all of the money used to service foreign currency debt has to come from a country's balance of payments transfers.

See also

- Credit bubble

- Debt levels and flows

- Leverage (finance)

- List of countries by public debt

- List of countries by external debt

- List of countries by tax revenue as percentage of GDP

Notes

- ^ Currency/(Currency/Time) = Time

References

- ^ https://www.cia.gov/library/publications/the-world-factbook/geos/us.html

- ^ https://www.cia.gov/library/publications/the-world-factbook/geos/ja.html

- ^ https://www.cia.gov/library/publications/the-world-factbook/geos/gm.html

- ^ Bivens, L. Josh (December 14, 2004). Debt and the dollar Economic Policy Institute. Retrieved on July 8, 2007. p. 2, "US external debt obligations."

Categories:- Government debt

- Financial ratios

Wikimedia Foundation. 2010.