- Cost-of-production theory of value

-

In economics, the cost-of-production theory of value is the theory that the price of an object or condition is determined by the sum of the cost of the resources that went into making it. The cost can compose any of the factors of production (including labor, capital, or land) and taxation.

The theory makes the most sense under assumptions of constant returns to scale and the existence of just one non-produced factor of production. These are the assumptions of the so-called non-substitution theorem. Under these assumptions, the long run price of a commodity is equal to the sum of the cost of the inputs into that commodity, including interest charges.

Contents

Historical development of theory

Historically, the most well known proponent of such theories is probably Adam Smith. Piero Sraffa, in his introduction to the first volume of the "Collected Works of David Ricardo", referred to Adam Smith's adding up theory. Smith contrasted natural prices with market price. Smith theorized that market prices would tend towards natural prices, where outputs would be at what he characterized as the "level of effectual demand". At this level, Smith's natural prices of commodities are the sum of the natural rates of wages, profits, and rent that must be paid for inputs into production. (Smith is ambiguous about whether rent is price-determining or price determined. The latter view is the consensus of later classical economists, with the Ricardo-Malthus-West theory of rent.)

David Ricardo mixed such cost of production theory of prices with the labor theory of value, as that latter theory was understood by Eugen von Bohm-Bawerk and others. This is the theory that prices tend toward proportionality to the socially necessary labor embodied in a commodity. Ricardo sets this theory at the start of the first chapter of his "Principles of Political Economy and Taxation". Ricardo also refutes the labor theory of value in later sections of that chapter. This refutation leads to what later became known as the transformation problem. Karl Marx later takes up that theory in the first volume of "Capital", while indicating that he is quite aware that the theory is untrue at lower levels of abstraction. This has led to all sorts of arguments over what both David Ricardo and Karl Marx "really meant". Nevertheless, it seems undeniable that all the major classical economics and Marx explicitly rejected the labor theory of price [1]([1]).

A somewhat different theory of cost-determined prices is provided by the "neo-Ricardian school" of Piero Sraffa and his followers.

The Polish economist Michał Kalecki [2] distinguished between sectors with "cost-determined prices" (such as manufacturing and services) and those with "demand-determined prices" (such as agriculture and raw material extraction).

One might think of this theory as equivalent to modern theories of markup-pricing, full-cost pricing, or administrative pricing. Ever since Hall and Hitch,[2] economists[citation needed] have found that the evidence gathered in surveys of businessmen support such theories.

Most contemporary economists accept neoclassical economics or mainstream economics. The non-substitution theorem is presented in graduate level microeconomics textbooks as a theorem of mainstream economics. Also many mainstream economists think they can justify theories of full-cost pricing within their theory. The majority of mainstream economists would probably then accept this theory as an element in their theory which does not give adequate attention to issues of consumer demand and marginal utility.

Market price

Market price is an economic concept with commonplace familiarity; it is the price that a good or service is offered at, or will fetch, in the marketplace; it is of interest mainly in the study of microeconomics. Market value and market price are equal only under conditions of market efficiency, equilibrium, and rational expectations.

In economics, returns to scale and economies of scale are related terms that describe what happens as the scale of production increases. They are different terms and are not to be used interchangeably.

Labor theory of value

The labor theories of value (LTV) are theories in economics according to which the true values of commodities are related to the labor needed to produce them.

There are many different accounts of labor value, with the common element that the "value" of an exchangeable good or service is, or ought to be, or tends to be, or can be considered as, equal or proportional to the amount of labor required to produce it (including the labor required to produce the raw materials and machinery used in production).

Different labor theories of value prevailed amongst classical economists through to the mid-19th century. It is especially associated with Adam Smith and David Ricardo. Since that time it is most often associated with Marxian economics; while among modern mainstream economists it is considered to be superseded by the marginal utility approach.

Taxes and subsidies

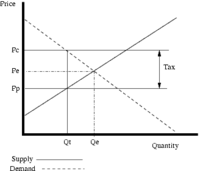

Taxes and subsidies change the price of goods and services. A marginal tax on the sellers of a good will shift the supply curve to the left until the vertical distance between the two supply curves is equal to the per unit tax; when other things remain equal, this will increase the price paid by the consumers (which is equal to the new market price), and decrease the price received by the sellers. Marginal subsidies on production will shift the supply curve to the right until the vertical distance between the two supply curves is equal to the per unit subsidy; when other things remain equal, this will decrease price paid by the consumers (which is equal to the new market price) and increase the price received by the producers.

See also

- production, costs, and pricing

- list of economics topics

- prices of production

Notes

Categories:- Production economics

- History of economic thought

- Value theory

- Value

Wikimedia Foundation. 2010.