- Rebate (marketing)

-

For other uses, see rebate (disambiguation).

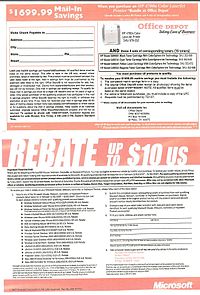

A rebate is an amount paid by way of reduction, return, or refund on what has already been paid or contributed. It is a type of sales promotion marketers use primarily as incentives or supplements to product sales. The mail-in rebate (MIR) is the most common. A MIR entitles the buyer to mail in a coupon, a receipt and barcode in order to receive a check for a particular amount, depending on the particular product, time, and often place of purchase. Rebates are offered by either the retailer or the manufacturer of the chosen product. Large stores often work in conjunction with manufacturers, usually requiring two or even three separate rebates for each item. Manufacturer rebates are sometimes valid only at a single store. Rebate forms and special receipts are sometimes printed by the cash register at time of purchase on a separate receipt or available online for download. In some cases, the rebate may be available immediately, in which case it is referred to as an instant rebate. Some rebate programs offer several payout options to consumers, including a paper check, a prepaid card that can be spent immediately without a trip to the bank or even PayPal payout.

Contents

Uses

Rebates are heavily used for advertised sales in retail stores in the United States, such as Best Buy and Staples. However, Best Buy, in April 2005, announced that they would be eliminating all mail-in-rebates.[1] Personal computer components and electronics seem to have a large portion of rebate sales. For example, an item might be advertised as "$39 after rebate" with the item costing $79 OTD (out-the-door) with a $40 rebate that the customer would need to redeem. The turnaround time is generally four to eight weeks, though some rebates note a period of eight to twelve weeks. In the UK rebates are not common, with manufacturers and retailers preferring to give discounts at the point of sale rather than requiring mail-in or coupons.

Retailer Staples offers the popular Easy Rebates program, which enables customers to use paperless submission for rebates, offers a choice of rewards and quick payment. Rebate provider Parago is credited with redesigning and managing Easy Rebates. After a decade of working together, Staples extended its contract with Parago for another five years in 2010.[2]

Rebate clearinghouses

Most rebates are handled under contract by rebate clearinghouses that specialize in processing rebates and contest applications. The source of their fees is not readily discernible with conflicting reports from different sides. Roger D. Andersen, former CEO of Young America, a rebate clearinghouse claims that "Young America receives the same fees whether a submission is valid or invalid," giving them no incentive to unfairly invalidate customer rebates.[3] Young America is currently under investigation by the state of Massachusetts for keeping unclaimed rebate checks.[4] Frank Giordano, founder of TCA Fulfillment, claims "We get paid for every redemption request we enter in the system. If we don't put it in the system, we don't get paid.".[5] TCA is also notable for a "Rebate Redemption Guide" that was sent to prospective clients touting the low redemption rates that they would have with TCA as their rebate fulfillment center, promising 20% less than their competitors.[3]

Regulations and laws

In the United States, Connecticut state regulations section 42-110b-19(e) require retailers who advertise the net price of an item after rebate to pay consumers the amount of that rebate at time of purchase.[6] Rhode Island has similar legislation (Gen. Laws 6-13.1-1).[7] Otherwise, the after-rebate price cannot be advertised as the final price to be paid by the consumer. For example, retailers in Connecticut can advertise only "$40 with a $40 rebate," not "Free After Rebate," unless they give the rebate at the time of purchase,[8][9]

Rationale

Rebate forms often ask for the same type of information-proof of purchase in the form of a receipt and/or UPC and contact information of the purchaser.

Rebates have become very popular in retail sales within the United States. Retailers and manufacturers have many reasons to offer them:

- The information given in the rebate form, such as name, address, method of payment, can be used for data mining studies of consumer behavior.[10]

- The information can be used as evidence of a pre-existing business relationship for marketing purposes, such as do not call lists.

- Customers tend to notice price increases and react negatively. Rebates offer retailers the benefit of giving customers a temporary discount on an item, to stimulate sales, while allowing it to maintain its current price point. This method avoids the negative backlash that could be perceived with a price being lowered and then raised later.[11]

- Rebates also allow companies to "price protect" certain product lines by being selective in which models or brands to be discounted. This allows retailers and manufacturers to move some product at lower cost while maintaining prices of successful models. A straight price reduction on some models would have a domino effect on all products in a line.[12]

- During the turnaround time, the company can earn interest on the money.

- If the turnaround time crosses into the next fiscal year or quarter, a rebate offer can inflate sales in the current period, and not have to be accounted for until the next period and then it could be attributed as a cost reducing sales or expense for the next period giving companies an accounting advantage with their Wall Street projections.

- Extended warranties and other price-dependent factors always use the initial purchase price, not the price after the rebate. This is normally because if the company has to refund the customer the "replacement value", it would be the before rebate "in-store" price.

- Once the UPC has been removed from the box, retailers can refuse to accept a return of the item.

- Not all buyers will meet the criteria to receive the rebate. Companies often require the original UPC barcode, receipt, and additional information, which a buyer may forget to include when redeeming the rebate. Companies almost always add other caveats to the rebate as well, such as the redemption having to be postmarked by a certain date. It works in the company's favor if buyers do not act quickly to redeem. However, a University of Florida study notes that shorter redemption periods actually increase the redemption rate in the consumer's favor because it gives them less time for procrastination to set in.[13]

- New companies that want to make a break into a market can offer substantial rebate savings on their new product as a means of capturing a customer's attention. Zeus Kerravala, vice president at the Yankee Group, has said "For companies that haven't been in a particular market, the rebate that essentially refunds the customer's money is a great way to get people to pay attention to them. This is especially true in consumer electronics, where brand name does matter. It's a good way to get customers to take a chance on a new brand."[14]

Benefits and costs for consumers

Rebates may offer customers lower pricing. Deal hunter sites frequently tout the benefits of rebates in making technology affordable: "Rebates are the meat and potatoes of the ultimate tech deal, no matter what you are buying… They are paying you money to buy their stuff. All you have to do is take it."[15]

According to 2011 research from Parago, a leading consumer incentives and rebate provider, 47% of consumers submitted a rebate in the past 12 months, whereas similar research conducted in 2009 showed that only 37 percent of consumers had submitted a rebate in the prior year.[16]

Industry advisers note that if mail-in rebates go away, they will not be replaced by "instant rebates" of the same value amount because of the loss of the tangible benefits listed above (fiscal accounting, price protection, etc.) Steve Baker, vice president of industry analysis for NPD Group, comments that "It's a case of be careful of what you ask for. You may see some great deals go away."[17]

Rebates take a certain amount of time and effort from the consumer - figuring out the rules, filling out the forms, preparing and dropping off the mailing, cashing in the cheque, keeping track of the paperwork while this is being done. Thus, a rebate can be thought of as being paid to do this paperwork and provide one's personal data to the company. Chances of rebate mailing being lost or failing some criteria may further reduce the expected return on this effort.

If the total estimated time to be spent by the consumer for the whole rebate submission, multiplied by consumer's hourly salary rate (or even the minimum wage), is comparable to or above the rebate amount, then it can be seen as not worth the time.

Consumers who are aware of this, and who value their time, effort and opportunity costs above the value of the rebate may choose to intentionally ignore a non-instant rebate that requires such procedures and assume the out-the-door price when considering the purchase.

On the other hand, if the consumer does not see it this way, or their income and budget are extremely limited or non-existent, and/or they are more concerned with the price than their time for any reason, the rebate may be seen as a reasonable deal.

Consumers enjoy the convenience of receiving rebates on prepaid cards, and 95% of consumers say they would definitely or maybe choose a prepaid rebate card over other options like checks.[18]

Redemption rate inconsistencies

It is difficult to get an account of redemption rates from most rebate companies, partly due to a reluctance on the part of rebate fulfillment houses to release confidential business information. Among different sources, radically different numbers on both ends of the spectrum can be cited. Part of the reason is that most "redemption rates" do not distinguish whether they are calculated as part of total sales or incremental sales.

- PMA, a marketing firm, estimated that in 2005 $486.5 million worth of rebates were redeemed. The redemption rates averaged 21.1% when calculated as a percentage of total sales, and 67.6% when calculated as a percentage of incremental sales. They go on to note “These statistics reveal that redemption rates calculated as a percentage of total sales can be misleading when diluted by non-incremental sales, consequently making redemption rates appear lower than they truly are.”[19]

- Not all buyers remember to mail the coupons, a phenomenon known in the industry as breakage, or the shoebox effect. Though it can be used interchangeably with breakage,[20] slippage is the phenomenon when a consumer has their rebate fulfilled but they lose or forget to cash the check. Some rebate companies could tout a higher "redemption rate" including the breakage, while not calculating the potential slippage of uncashed checks.

Some redemption estimates

- BusinessWeek recently[when?] estimated a return rate of 60 percent. Some estimates have been as low as 2%. For example, nearly half of the 100,000 new TiVo subscribers in 2005 did not redeem their $100 rebates, allowing the company to keep $5,000,000 in additional profit.[3]

- PC Data in the Reston, VA estimates between "10 and 30 percent".[21]

- PlusNetMarketing in Wilmington, DE quotes 80%[22]

- A representative in 2005 from The Marco Corporation stated“In some cases, we do have redemption programs that go as high as forty to fifty per cent, but generally it’s about one to five per cent”. In the same article, John Challinor, advertising manager for Sony Canada remarks that “The industry average is less than ten percent....and it can be as low as one percent.[20]

- NPD Group, a marketing firm, estimates 50% to 70%[17]

General complaints

At some big box stores, personal computers are regularly sold with sizable rebates attached, making the advertised price more attractive to buyers. It is common, though, for these rebates to be conditional upon signing a long term contract with a particular ISP, to which some customers may object. Hardware manufacturers have come under fire, also. Dell, for one, has been the subject of rebate complaints involving misprinted receipts, potentially confusing expiration dates, and service representatives who are slow to react.

Rebate issues began to clog Dell's customer service forums, leading the company to shut down that portion of the website,[23] and refocus its energy on new online customer care solutions. CompUSA used rebates regularly until it started closing its remaining stores in December 2007.

Cell phone service companies, including major players like T-Mobile, as well as third-party retailers like Radio Shack, Wirefly and others have received growing attention due to complex rebate redemption rules. Both carriers and retailers make customers submit rebate claims during a 30-day window, often 6 months after cell phone activation.[24] Some authorized dealers have responded by trying to make rebate requirements more transparent, explaining that the carrier will withdraw payment from them if a customer quits service before the end of the contract.

In 2009, Florida State Attorney General Bill McCollum filed suit against Tiger Direct, OnRebate, and their parent company Systemax, charging the companies with failing to provide rebates to customers.

Rebates as a form of price discrimination

A common complaint against rebates is the claim that rebates can be used as a form of "price discrimination" against members of lower classes who are less likely to redeem rebates than a more educated middle class.[11] Sridhar Moorthy, marketing professor at the University of Toronto also advocates a “price discrimination” theory between “people who are price-sensitive and people who are not price-sensitive.”.[20] A different view, as taken by the BusinessWeek article, is that rebates can be viewed as a “tax on the disorganized” that is paid by those who do not submit their rebates as opposed to those who do.

Recent trends

Some retailers have taken a step forward with offering consumers new ways to submit their rebates easily over the Internet, completely or partially removing any mail-in requirements. Staples, Sears, Tiger Direct and Rite Aid currently offer an online submission option for all or some of the rebates they offer. These special rebates are usually identified as such and have instructions for full or partial online submissions. This is touted as a more accurate processing of the rebate, reducing the potential for human or mechanical error and in many cases eliminating the postage costs associated with traditional mail-in rebates, although some require the UPC or Proof Of Purchase to be mailed in. Most of these retailers still let consumers submit rebates by mail.

In 2006 OfficeMax stores announced that they were eliminating mail-in rebates from their sales promotion in favor of instant rebates for their sale prices. The decision came after a year of working with rebate vendors and manufacturers to improve the rebate process and receiving "overwhelmingly negative feedback" from their customers about their rebate program.[25]

Instead of checks, prepaid gift cards are being given by many stores. Merchants like these cards, as they cannot be redeemed for cash and must be spent. However, some states require that retailers redeem the card value for cash if it falls below a certain level, such as $5 in Washington state.[26] Many sales people are not aware of this and will deny giving the refund. Consumers must be careful of expiration dates and read the fine print.[27]

According to research from Parago, a leading consumer incentives and rebate provider, the typical American household that takes advantage of consumer rebates saves an average of $150 annually. More than $8 billion dollars were issued back to American households last year alone by rebate programs.[28]

References

- ^ Peter Pollack Best Buy begins rebate elimination program 1/25/2006

- ^ Jennifer Mosscrop Staples and Parago partner for incentives and rebates Chain Store Age | September 29, 2010

- ^ a b c Brian Grow The Great Rebate Runaround Business Week Online Nov. 23rd 2005

- ^ Dept. of Massachusetts State Treasurer Timothy Cahill CAHILL FILES SUIT AGAINST REBATE COMPANY Press release Nov 7th, 2005

- ^ Janet Rae-Dupree and Tom Spring Rebate Roulette PC World

- ^ Connecticut Unfair Trade Practices Act Regulations

- ^ Rhode Island Deceptive Trade Practices Chapter 6-13.1

- ^ Regs., Conn. State Agencies Sec. 42-110b-19

- ^ Mail-in Consumer Rebates 2003-R-0523

- ^ us 6847935

- ^ a b R. Avila and T. Avila Rebates: An ethical issue? Ball State University

- ^ Henry Norr The How and Whys of Rebates Dec. 18th 2000

- ^ University of Florida News Redemption Of Mail-In Rebates Declines With Increased Time Allowance June 15th, 2004

- ^ Elizabeth Millard The Fine Print of IT Rebates E-Commerce Times June 13th, 2003

- ^ Drew Unger How to get Insane Deals: The Ultimate Tech Challenge CPA advisor

- ^ Parago announces surging rebate activity in 2010 February 2011

- ^ a b Melinda Fulmer Don't get ripped off by a rebate 'deal' MSN Money

- ^ Arlene Hauben Modernizing Rebates: Paper Checks to Prepaid Cards The Prepaid Press | May 15, 2010

- ^ Promotion Marketing Association, Inc PMA Mail-in Rebate Benchmarking Study, 2005 May 1st, 2005

- ^ a b c CBC News Marketing rebates: The science of 'slippage' Jan. 2nd, 2005

- ^ Henry Norr The How And Why Of Rebates Dec. 18th, 2005

- ^ James E. Gaskin Beating the rebate runaround, Part 4 Network World March 1st, 2004

- ^ Carla Thorton Dell Closes Longtime Customer Message Boards PC World July 14th, 2005

- ^ Bob Sullivan CONSUMERS IRKED BY CELL PHONE REBATES ON HOLD MSNBC

- ^ E. Ogg OfficeMax bids farewell to mail-in rebates June 30, 2006

- ^ Holiday Shopping: Consumers Have Rights Under Washington’s Gift Card Law [1] July 15, 2011

- ^ E. Sandberg Prepaid cards replace checks as rebate payment of choice Dec 26, 2009

- ^ Rebate programs return more than $8 billion to US households June 2, 2011

External links

- FatWallet Rebate Info Thread Extensive listing of Rebate Companies, contact info and complaint avenues

Chisholm, Hugh, ed (1911). "Rebate". Encyclopædia Britannica (11th ed.). Cambridge University Press.

Chisholm, Hugh, ed (1911). "Rebate". Encyclopædia Britannica (11th ed.). Cambridge University Press.

Categories:

Wikimedia Foundation. 2010.