- Society of Actuaries

-

Society of Actuaries

Society of Actuaries logoAbbreviation SOA Motto "The work of science is to substitute facts for appearances and demonstrations for impressions." -John Ruskin[1] Formation 1949 Type Professional body Headquarters Schaumburg, Illinois Location United States of America Membership 22,604[2] Official languages English President Bradley M. Smith Website soa.org The Society of Actuaries (SOA) is a professional organization for actuaries based in North America. It was founded in 1949 as the merger of two major actuarial organizations in the United States: the Actuarial Society of America and the American Institute of Actuaries.[3] It is a full member organization of the International Actuarial Association.[4]

The Society's vision is for actuaries to be recognized as the leading professionals in the modeling and management of financial risk and contingent events. The SOA has three overall goals: providing primary and continuing education for students and practicing actuaries, maintaining high professional standards for actuaries, and conducting research on actuarial trends and public policy issues.[5]

The SOA represents American actuaries from all major areas of practice except property and casualty insurance, which are represented by the Casualty Actuarial Society.

The SOA, along with its public relations firm GolinHarris, won the PR Week Corporate Branding Campaign of the Year award for 2008. The award was given for the Society's efforts to revitalize the actuarial profession's brand in the US, including the slogan "Risk is Opportunity."[6]

Contents

History

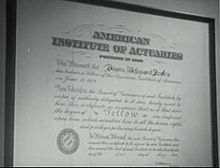

The Society was founded as a merger of two major American actuarial associations, as reflected in its logo: the Actuarial Society of America (ASA) and the American Institute of Actuaries (AIA).

The Actuarial Society of America was the first actuarial professional association in North America, founded in 1889 with only 38 members and headquartered in New York City.[7] Initial members were included by invitation, but the organization soon adopted a system of examination for qualification, with the first Fellow to qualify via exams joining in 1900.

The American Institute of Actuaries was founded in 1909. Based in Chicago, it attracted members from life insurance companies in the midwestern and southern United States. The formation of the AIA, which (like the ASA) was geared toward actuaries in the field of life insurance, was followed within the decade by the creation of two other specialized actuarial organizations: the Casualty Actuarial Society, which still exists today, and the Fraternal Actuarial Association which dissolved in 1980.

Between the two organizations, which came to have some overlap in membership, the number of recognized professional actuaries climbed from the initial 38 to over 1000 by the time the two organizations merged in 1949 to form the SOA. The SOA has seen continued growth since then, now recognizing over 20,000 professional actuaries as active members.

Leadership Structure

The SOA is headed by a board of directors consisting of a president, president-elect, six vice presidents (one of which serves as the secretary/treasurer) and eighteen other board members.[8] In addition, the two most recent past presidents are members of the board.

The board positions are filled by election. A member of the society is eligible to vote in board elections if they have the title of FSA, or if they have held the title of ASA for at least 5 years, and only FSAs can be elected to the board. (See the Membership section below for information on the professional titles granted by the society.) Regular board members are elected for terms of three years, and vice presidents are elected for terms of two years. The president-elect is elected for a term of one year, after which he or she becomes the president for a term of one year. The decision by the board in June 2010 (and again in the 2011 elections), to deny Tom Bakos the right to stand for president-elect, despite Mr Bakos having been nominated by dozens of members (109 in 2010) has proved controversial, and is a subject of intense debate on the Actuarial Outpost.

The employees of the SOA are headed by the executive director, a salaried position appointed by the board of directors.

Membership

The Society's members are mainly involved in the life, health, and pension areas of the actuarial profession. There are three designations offered by the Society. The two Associate-level designations are Associate of Society of Actuaries (ASA) and Chartered Enterprise Risk Analyst (CERA), which was introduced in 2007. The highest designation is Fellow of the Society of Actuaries (FSA). As of April 1, 2011, SOA membership consisted of 8,712 Associates and 13,489 Fellows.[9]

Requirements for membership for the SOA include the actuarial exams, a comprehensive series of competitive exams. Topics covered in the exams include mathematics, finance, insurance, economics, interest theory, life models, and actuarial science. Non-members working in the actuarial profession and taking exams are often referred to as actuarial students or candidates.

Members of the SOA who meet a professional experience requirement are eligible for membership in the American Academy of Actuaries, which represents United States actuaries from all practice areas.[10]

Examination System

Professional designations in the Society are earned by completing a rigorous system of examination. It is common for actuarial students to work full time in the profession while studying for the exams.

The first five ("preliminary") exams consist mostly of core mathematics related to actuarial science including probability, statistics, interest theory, life contingencies, and risk models.[11]

A series of online learning modules, called the Fundamentals of Actuarial Practice (FAP), are intended to be taken after the preliminary exams. They cover real-world topics such as insurance and professionalism with readings, case studies and projects.[12] The preliminary exams and FAP modules comprise the majority of the education requirement for the ASA designation.

Upper-level exam topics for the FSA designation include plan design, risk classification, ratemaking and valuation. Two fellowship exams are taken in one of five specialization tracks chosen by the candidate - Finance & Enterprise Risk Management, Investments, Individual Life Insurance & Annuities, Retirement Benefits or Group & Health Insurance.[13]

See also

References

- ^ About the SOA: History, retrieved September 21, 2009

- ^ http://www.soa.org/about/membership/about-analysis-of-membership.aspx

- ^ http://www.soa.org/about/history/about-historical-background.aspx

- ^ http://www.actuaries.org/index.cfm?lang=EN&DSP=ABOUT&ACT=MEMBERS_FULL

- ^ http://www.soa.org/about/overview/default.aspx

- ^ "Corporate Branding Campaign of the Year 2008," PR Week, March 06, 2008

- ^ http://soa.org/about/history/about-historical-background.aspx

- ^ http://www.soa.org/files/pdf/bylaws-soa.pdf

- ^ http://www.soa.org/about/membership/about-analysis-of-membership.aspx

- ^ http://actuary.org/beco.asp#3

- ^ http://www.soa.org/education/exam-req/edu-asa-req.aspx

- ^ http://www.soa.org/education/exam-req/syllabus-study-materials/edu-fap-overview.aspx

- ^ http://www.soa.org/education/exam-req/edu-fsa-req.aspx

External links

Categories:- Actuarial associations

- Professional associations based in the United States

- Organizations based in Schaumburg, Illinois

- Non-profit organizations based in Illinois

Wikimedia Foundation. 2010.