- Price skimming

-

Price skimming is a pricing strategy in which a marketer sets a relatively high price for a product or service at first, then lowers the price over time. It is a temporal version of price discrimination/yield management. It allows the firm to recover its sunk costs quickly before competition steps in and lowers the market price.

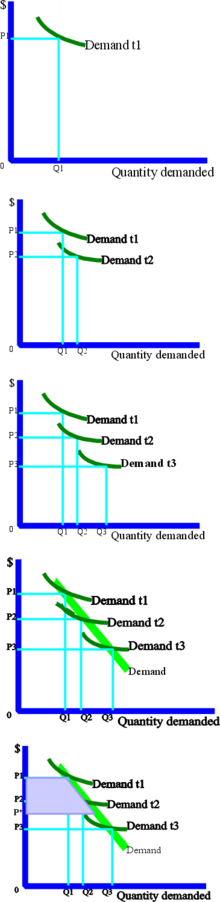

Price skimming is sometimes referred to as riding down the demand curve. The objective of a price skimming strategy is to capture the consumer surplus. If this is done successfully, then theoretically no customer will pay less for the product than the maximum they are willing to pay. In practice, it is almost impossible for a firm to capture all of this surplus.

Contents

Limitations of price skimming

There are several potential problems with this strategy.

- It is effective only when the firm is facing an inelastic demand curve. If the long run demand schedule is elastic (as in the diagram to the right), market equilibrium will be achieved by quantity changes rather than price changes. Penetration pricing is a more suitable strategy in this case. Price changes by any one firm will be matched by other firms resulting in a rapid growth in industry volume. Dominant market share will typically be obtained by a low cost producer that pursues a penetration strategy.

- A price skimmer must be careful with the law. Price discrimination is illegal in many jurisdictions, but yield management is not. Price skimming can be considered either a form of price discrimination or a form of yield management. Price discrimination uses market characteristics (such as price elasticity) to adjust prices, whereas yield management uses product characteristics. Marketers see this legal distinction as quaint since in almost all cases market characteristics correlate highly with product characteristics. If using a skimming strategy, a marketer must speak and think in terms of product characteristics in order to stay on the right side of the law.

- The inventory turn rate can be very low for skimmed products. This could cause problems for the manufacturer's distribution chain. It may be necessary to give retailers higher margins to convince them to handle the product enthusiastically.

- Skimming encourages the entry of competitors. When other firms see the high margins available in the industry, they will quickly enter.

- Skimming results in a slow rate of stuff diffusion and adaptation. This results in a high level of untapped demand. This gives competitors time to either imitate the product or leap frog it with a new innovation. If competitors do this, the window of opportunity will have been lost.

- The manufacturer could develop negative publicity if they lower the price too fast and without significant product changes. Some early purchasers will feel they have been ripped off. They will feel it would have been better to wait and purchase the product at a much lower price. This negative sentiment will be transferred to the brand and the company as a whole.

- High margins may make the firm inefficient. There will be less incentive to keep costs under control. Inefficient practices will become established making it difficult to compete on value or price.

Examples of price skimming

- Price skimming has been used for certain high-end electronics. For instance, the Sony PlayStation 3 was initially sold at $599, but the price has gradually reduced to $299.

Reasons for price skimming

Price skimming occurs in mostly technological markets as firms set a high price during the first stage of the product life cycle. The top segment of the market which are willing to pay the highest price are skimmed of first. When the product enters maturity the price is lowered.

See also

- Pricing

- Marketing

- Microeconomics

- Production, costs, and pricing

- Business model

Wikimedia Foundation. 2010.