- Compagnie Française d'Assurance pour le Commerce Extérieur

-

The Compagnie Française d'Assurance pour le Commerce Extérieur (COFACE) was founded in 1946 as the French export credit agency. It was subsequently privatized by the government and continued as a commercial enterprise. Currently, COFACE is owned by the bank group Natixis.

Coface provides guarantees or insurance on accounts receivable arising from the sales of commercial goods and services on credit terms of 30-day and 60-day time scales especially for export companies (as an alternative to making the foreign purchaser obtain a letter of credit), sometimes on longer time scales; it manages state guarantees for exports by French corporations; and also provides some other international support for exporters.

Coface is a world leader in trade-credit information and protection (Trade Credit Insurance), serving 160,000 clients in 93 countries. The company has been expanding into the related fields of trade finance, including factoring, and accounts receivable management.

Furthermore, together with creditreform la Coface launch an International identifier EasyNumber which gives to every single Business Unit of an economic actor. This service is manage by a joint venture EasyNumber Company SA.[1]

In the UK and Ireland, Coface UK provides:

- Accounts Receivable Insurance (Trade Credit Insurance)

- Single Risk and Political Risk Protection

- International Business Information

- Commercial Collection Services

- Country Risk Information

- Receivables Finance

- Performance Bonds & Duty Deferment Guarantees (Surety)

In North America, Coface North America provides:

- Accounts Receivable Insurance (Trade Credit Insurance)

- Single Risk and Political Risk Protection

- Receivables Finance

- International Business Information

- Commercial Collection Services

- Kompass Business to Business Search Engine

- Country Risk Information

In Australia, Coface Services Australia provides:

- Company Information

- Receivables Management

- Receivables Protection (Trade Credit Insurance)

- Receivables financing

Contents

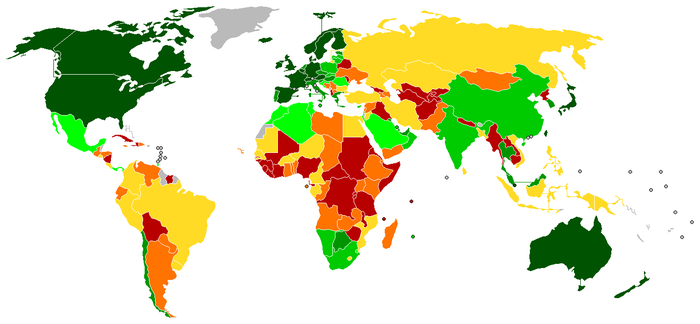

Country risks rating

Coface assigns a rating to each of the 150 countries it monitors; this rating reflects the average risk of short-term non-payment for companies in this country. Seven families are used:

- A1 : Steady political and economic environment, good payment record of companies, very weak default probability

- A2 : Political and economic environment or payment record of companies not as good as A1, default probability being still weak

- A3 : Payment record usually lower than A1 and A2, likely to be modified by adverse political or economic circumstances, probability of a payment default being still low

- A4 : Patchy payment record, likely to be modified by a deteriorating political and economic environment, probability of a default being still acceptable

- B : Unsteady political and economic environment, usually poor payment record

- C : Very unsteady political and economic environment, frequently bad payment record

- D : High risk profile of the economic and political environment, very bad payment record.

Equivalent in the world

- France : Euler Hermes

- United Kingdom : ECGD

- United States of America : Eximbank

References

External links

- Coface official website

- Coface Australia official website

- Coface UK official website

- Coface Brazil official website

- Coface Ireland official website

- Coface North America official website

- Coface Mexico official website

- Coface Nederland official website

- Coface Colombia official website

- Coface Ecuador official website

- Coface Venezuela official website

- Coface Perú official website

- Coface Romania official website

- Kompass International website

- BdiCoface International website

- BdiCode - Israel's leading companies ranking

Afianzadora Latinoamericana (Argentina) · Allianz SE (Germany) · Askrindo (Indonesia) · Aspen Re Europe (Switzerland) · Atradius (worldwide) · AXA Assurcredit (France) · AXA-Winterthur (Switzerland) · AXIS Re (Ireland) · Catlin Re (Switzerland · CESCE (Spain) · China National Investment & Guaranty Company (China) · CLAL (Israel) · Coface (worldwide) · COSEC (Portugal) · CGIC (South Africa) · Ducroire/Delcredere (Belgium) · ECICS (Singapore) · Euler Hermes (worldwide) · Fianzas Atlas (Mexico) · Fianzas Monterrey (Mexico) · Garant (Austria) · Groupama (France) · GCNA (Canada) · Hannover Re (worldwide) · HCC International (UK) · ICIC (Israel) · Lombard Insurance Company (South Africa) · Mapfre (Spain) · Mitsui Sumitomo (Japan) · Munich Re (worldwide) · Nationale Borg (Netherlands) · Novae Group plc (UK) · Partner Re (worldwide) · PICC (China) · Prisma (Austria) · QBE Insurance (Australia) · SACE BT (Italy) · SCOR Switzerland (worldwide) · Seoul Guarantee Insurance Company (Korea) · SID First Credit (Slovenia) · Sompo Japan (Japan) · Swiss Re (worldwide) · Tokio Marine & Nichido Fire (Japan) · Tryg Garanti (Denmark) · Zurich Insurance plc (Germany) Zurich Surety, Credit & Political Risk (USA) · Zurich Surety UK (UK) ·

Categories:- Insurance companies

- Export credit agencies

- Credit rating agencies

Wikimedia Foundation. 2010.