- Mobile Payments in India

-

Mobile Payments is a new and alternate mode of payment using mobile phones. Instead of using traditional methods like cash, cheque, or credit cards, a customer can use a mobile phone to transfer money or to pay for goods and services. A customer can transfer money or pay for goods and services by sending an SMS, using a Java application over GPRS, a WAP service, over IVR or other mobile communication technologies . In India, this service is Bank-led.[1] Customers wishing to avail themselves of this service will have to register with Banks which provide this service. Currently, this service is being offered by several major banks and is expected to grow further.[2] Mobile Payment Forum of India (MPFI) is the umbrella organisation which is responsible for deploying mobile payments in India.[3]

Contents

Background

India has a vast un-banked population,[4] most of whom reside in the rural areas. The traditional banking industry can not cater to the needs of India's large rural populace.[5] Setting up a conventional branch in a rural area would require considerable amounts of money to be spent on infrastructure and additional personnel. Most of rural Indians are cut-off from access to basic financial services which includes deposits and withdrawals from a trusted source.

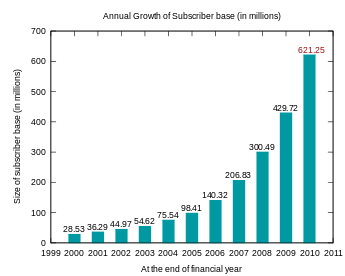

The Growth of Mobile Phones in India

However, India is the second largest telecommunications market and has more than 650 million mobile phone customers.[6] Mobile phones are quite common even in the remote villages. The mobile phone industry is growing at a rate of 100 million per year. It is expected to touch the 1 billion mark by 2013.[7] The share of the urban subscribers is 66% and the share of the rural subscribers was 34%. In the month of May 2011, the net monthly addition in terms of the number of subscriptions was 13.35 million. Of these 13.35 million new subscriptions, 7.33 million were from the urban segment and 6.02 million from the rural segment. The subscription growth rate on a monthly basis is 55% for urban segments and 45% for rural segments.[8] Given this context, it is possible to consider the mobile phone as an economically viable instrument to enable inclusive access to financial services.

Impact of Mobile Phones on Welfare

Mobile telephony has had an impact mainly by allowing for agents in information restricted areas to engage in more optimal arbitrage. The adoption of mobile phones by fishermen and wholesalers resulted in a dramatic reduction in price dispersion, the complete elimination of waste, and a near-perfect adherence to the Law of One Price. Both consumer and producer welfare increased. [9].

Mobile payments can have a positive impact on welfare by easing operational aspects and associated costs of cash-based transactions related to cash handling, storage and transfer, and by providing a strong platform for Financial Inclusion.

Model of Mobile Payments in India

The basic aim of mobile payments is to also enable micropayments on low-end mobile devices which support only voice and text, in addition to higher end phones which could support web-browsing or Java application capabilities. A person who has subscribed to a mobile payment service should be able to send money to any other person who has subscribed as well. This should be independent of the mobile network and the bank to which either of the persons belong. This is referred to as interoperability and is a key concern for any major technology to be successful.

In India, the model for the delivery of mobile financial services will be bank-linked;[10] This implies that customers wishing to avail themselves of this service should have:

- Initially, a registered mobile phone account with any network operator in the country, and

- A Bank account

- Register for the Mobile Payment service with the Bank

In contrast, in economies such as Kenya the mobile network operators lead the development of mobile financial services. Choosing a bank-linked model enables offerings of a variety of value added financial service built on top of the basic mobile payment transaction. The idea of mobile financial solutions will only then permeate to all levels of society; customers, merchants, business houses and the government.

The technical standards are set up by MPFI, which are implemented by the various participating entities after being ratified by the RBI.

Transaction Flow

The transaction flow can be simply described as 'customer-bank-bank-customer'. When a customer initiates a transaction by sending an SMS to the bank's gateway, this SMS is processed by a Mobile Payment Provider (MPP). The role of MPP is defined in the standards document. After appropriate checks with the customer's bank, the transaction is forwarded to a central switch. The role of the switching agency is played by the National Payments Corporation of India (NPCI). NPCI routes transaction to the payee's bank based on the MMID.

A transaction is initiated by sending the following details:

- Mobile number of the payee

- The 7-digit MMID of the payee

- Amount of money to be transferred

- The 4-digit PIN of the payer

Depending on the type of the transaction, either both parties (payer and payee) or only a single party is notified about the transaction. A successful transaction will be notified by an SMS to both parties.

The communication between the MPP's and the banks takes place using ISO 8583 message format,[11] which is the standard message format for all financial messages in India. In order to test the compliance and conformance to the standards set and the message formats, a Certification Lab is being setup at IIT Madras.

MMID

The Mobile Money IDentifier, is the key identifying detail of a user participating in a transaction. An MMID is a 7-digit number given to a customer upon registeration with a bank for the service.

In the 7-digits of the MMID,

- 4-digits are used to identify the bank of the user

- 3-digits are used to identify the account of the user

A mobile number and a MMID will uniquely identify a customer’s account with the respective bank. The design of the MMID allows customers to operate multiple bank accounts linked to a single mobile number; each bank account having its own MMID. Additionally, since the MMID of the payee must be entered along with the payee's mobile phone number, tt serves to reduce the possibility of an erroneous transaction when the payer inadvertently enters an incorrect mobile number.

It should be noted that the MMID is not intended to be a secret – it is simply an identifier and it does not give away any sensitive information about the customer. For example, a merchant will advertise his mobile number and MMID publicly in order to receive payments from the customers.

Communication Channels

The mobile payments service is available over a wide range of communication channels. The following communication channels are often used in combination to provide a complete end to end service[12]:

A user will use a particular set of communication channels depending on the capabilities of the mobile phone, The implementation of the standards will vary depending on the set used.

Application based

Most banks provide a Java application that can be downloaded on a Java-enabled phone which will guide the user through the money transfer process. An SMS sent through a Java application on the mobile device is as secure as an Internet Banking transaction, since it can be encrypted between the user and the bank.

SMS and IVR

An SMS–IVR combination is used for transactions for mobile phones without Java capabilities. An SMS is sent to a phone number provided by the bank, and an IVR call back is used for authentication and the transaction is carried forward as a voice-based transaction, at the end of which the user will be prompted to enter the MPIN. The SMS channel is used to send notification messages, while the IVR channel which is as secure as a GSM channel.

USSD

A transaction can also be initiated over USSD. A USSD session will provide the user with simple prompts over a menu allowing the user to input the payee's mobile number, MMID, and the user's own MMID and PIN for authentication.

Security

Every communication channel has its own set of security mechanisms. In addition, the RBI issued guidelines on security of mobile payments,[13] requires a two-factor authentication mechanism to be employed. A two-factor authentication in this context consists of:

- What you know: User PIN, MMID

- What you have: Mobile number, Mobile Phone, SIM Card

No transaction can take place without the use of the secret PIN. The guidelines also specify a cap on the amount of money that can be sent during transactions.

Use cases

Mobile payments enable a variety of possible uses, considering that the underlying architecture is interoperable and supports payments to other peers, merchants and government offices.

Pre-paid mobile top-up

Mobile top-up for prepaid mobile subscribers is one of the most common mobile related financial transactions. This would be made considerable easier, if the payment for topping up the mobile account can also be made over the mobile. There are already a wealth of online recharge options available and emerging, which point to the rapid growth in this business segment. [14]

Domestic peer-to-peer remittances

Mobile payments can also be used to remit money. Migrant workers (from other states) in India need to transfer money to their kin in their native states. This is often and arduous and expensive task for them.[15] Using this service, transfer of money is safe, fast and effective as established by a pilot study conducted.[16]mes.com/city/vadodara/Mobile-banking-facility-for-Surats-migrant-workers/articleshow/6493353.cms</ref>. This has potential to act as a very significant driver for adoption of mobile payment services in this demographic.

Bill and merchant payments

Bill payments provide convenience for the user and for utility companies. For payment to merchants, they offer another medium for the customer which vastly reduces cash management.

Governance

Mobile payments can have a large impact on interaction with government services and is being explored in India. [17]. Mobile payments are convenient to track and account for, key requirements in government payment transactions. Government to Peer payments can also be made easier and more effective[18] by using mobile payment channels[19] and is being explored for schemes like NREGA.[20]

New business opportunities

Mobile payments could also open the possibility for new business models as now, one would have the ability to pay and receive even small sums of money, almost instantaneously. A variety of value added services based on mobile payment transactions are already entering the market.[21]

Adoption of Mobile payments

There are various drivers that push the need and desire of mobile payments services in India, and there are several challenges which need to be addressed in order to ensure adoption of the technology in the Indian context. One of the key roles of The Mobile Payment Forum of India is to address these challenges that may inhibit the widespread use of mobile financial services.

Drivers for mobile financial services

- High penetration of mobile subscribers.[22]

- Mobile top-up services, domestic remittances and bill payments can be made very conveniently over a mobile phone.

- Growing demand, and an existing thriving ecosystem, for mobile services like ring tone downloads, Bollywood music, update for cricket matches, etcetera. Thus the uptake for another service, especially financial services, should be positive.

- Drive to be a part of the financial system for those people who currently do not have a bank account. The cost of cash handling, storage and transfer is very high in the informal sector. The ability to perform basic financial transactions over a mobile could act as a driver.

- There is a strong demographic dividend in India, where a large proportion of the population is very young. The young are often enthusiastic to take up new technologies and services.

Challenges for mobile financial services in India

- Poor levels of literacy are a problem, and voice-based services offer a potential solution. Voice-based solutions, especially in local languages, have two major benefits: they can work on all handsets and can be used by all irrespective of one’s comfort level with technology or level of literacy.

- The mobile financial services have to be effective in terms of usability, cost, efficiency, interoperability and security for transactions of all ticket sizes.

- M-payments options should be available even on low end mobile handsets.[23]

Financial Inclusion

The un-banked population can be classified into two broad categories: those who do not open accounts due to lack of banking infrastructure, and those who currently see no requirement to open an account.[24] This process can be broken into three aspects: opening a bank account, managing the account, and having access to a set of financial services and products. To open an account you have to satisfy the bank’s KYC (Know Your Customer) norms. For the un-banked, providing a valid identity is a challenge. To that end, the Unique Identification Authority of India (UIDAI) has embarked on a mission to offer a single source of identity verification which can also be used to open bank accounts. Managing the account is something that mobile money solutions will make much easier, faster and cheaper, both for the customers and the banks. The key challenge is to determine if it is possible to devise demand driven financial products and services which make for a compelling reason to open an account. For example, a common need is a low value, low cost loan, for which the un-banked can typically offer no collateral. If this need can be addressed, via an appropriate business model, then managing that loan in terms of repayments is much easier over a mobile device. In this context, mobile payment solutions can certainly help by providing an effective channel for money transfer for both categories of the un-banked.

The issue of depositing money into a bank account, where banks do not have a presence is addressed by the concept of Banking Correspondents.

Banking Correspondent

Though a mobile payment allows payments to be made electronically, they do not enable depositing money into a bank. The Reserve Bank of India (RBI) tended to this issue by creating the post of a banking correspondent (BC).[25] The role of a BC is to act as an interface between the bank and its customers in places where traditional banking is not feasible. Banks can appoint a trusted third-party as a BC in a village. All the villagers who wish to transact with the bank can get in touch with the BC. Deposit and withdrawal of money is handled by the BC. When a person deposits money at the BC, their account immediately gets credited. The person can then use their mobile phone for additional transactions.

Differences with Mobile Banking

The major difference between mobile banking and mobile payments is the total absenteeism of the bank account number. In mobile banking, or Internet banking, money can be transferred only when the account number of the payee is known before-hand. The account of the payee has to be registered with the payer and only then can a fund transfer happen.

In mobile payments, the account number is masked from being public. One need not know the account number of a person to transfer money[26] . This opens up a range of possibilities from buying tickets to paying auto fare, both of which would not have been feasible had the account number been mandatory for a simple transaction.

References

- ^ http://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=1750

- ^ http://www.npci.org.in/documents/IMPSFlow.pdf

- ^ http://www.mpf.org.in/about_us.html

- ^ http://www.cab.org.in/FILCPortal/Lists/Implementations/Attachments/10/operational_manual_financial.pdf

- ^ http://www.censusindia.gov.in/Census_Data_2001/Census_data_finder/A_Series/Number_of_Village.htm

- ^ http://www.coai.com/statistics.php

- ^ http://www.pwc.com/in/en/press-releases/India-will-have-over-hundred-million-3G-broadband-subscribers-by-2015.jhtml

- ^ http://www.trai.gov.in/annualreport/AnnualReport_09_10English.pdf

- ^ Jensen, Robert (2007). "The Digital Provide: Information (Technology), Market Performance, and Welfare in the South Indian Fisheries Sector". The Quarterly Journal of Economics 122 (3): 879–924.

- ^ http://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=1750

- ^ Kumar, D.; Gonsalves, T.A.; Jhunjhunwala, A.; Raina, G.; Communications (NCC), 2010 National Conference onDigital Object Identifier:10.1109/NCC.2010.5430160 Publication Year:2010, Page(s):1-5

- ^ www.mpf.org.in/pdf/Mobile%20Payment%20Systems%20and%20Services.pdf

- ^ http://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=1750

- ^ http://theagni.com/2011/07/28/state-of-online-recharge-mobile-services-in-india/

- ^ http://technology.cgap.org/2011/02/18/how-do-migrant-workers-move-money-in-india/

- ^ http://timesofindia.indiatimes.com/city/vadodara/Mobile-banking-facility-for-Surats-migrant-workers/articleshow/6493353.cms

- ^ http://www.thehindubusinessline.com/industry-and-economy/government-and-policy/article2397199.ece

- ^ www.cgap.org/gm/document-1.9.41174/FN58.pdf

- ^ cga.nic.in/pdf/DougJohnson.pdf

- ^ nrega.nic.in/circular/minutes%20ICT%20meeting%2017-11-2009.pdf

- ^ www.kpmg.com/TT/en/.../2011-mobile-payments-outlook.pdf

- ^ www.infogile.com/pdf/Mobile_Recharge.pdf

- ^ www.xenglobaltech.com/mobile-payments.pdf

- ^ http://www.rbi.org.in/scripts/bs_speechesview.aspx?id=342

- ^ http://www.rbi.org.in/scripts/NotificationUser.aspx?Mode=0&Id=2718

- ^ Kumar, D.; Gonsalves, T.A.; Jhunjhunwala, A.; Raina, G.; Communications (NCC), 2010 National Conference on Digital Object Identifier: 10.1109/NCC.2010.5430160 Publication Year: 2010 , Page(s): 1 - 5

External links

Categories:- Mobile payments

- Payment systems

Wikimedia Foundation. 2010.