- Solvency cone

-

The solvency cone is a concept used in financial mathematics which models the possible trades in the financial market. This is of particular interest to markets with transaction costs. Specifically, it is the convex cone of portfolios that can be exchanged to portfolios of non-negative components (including paying of any transaction costs).

Contents

Mathematically

If given a bid-ask matrix Π for d assets such that

and

and  is the number of assets which with any non-negative quantity of them can be "discarded" (traditionally m = d). Then the solvency cone

is the number of assets which with any non-negative quantity of them can be "discarded" (traditionally m = d). Then the solvency cone  is the convex cone spanned by the unit vectors

is the convex cone spanned by the unit vectors  and the vectors

and the vectors  .[1]

.[1]Definition

A solvency cone K is any closed convex cone such that

and

and  .[2]

.[2]Uses

A process of (random) solvency cones

is a model of a financial market. This is sometimes called a market process.

is a model of a financial market. This is sometimes called a market process.The negative of a solvency cone is the set of portfolios that can be obtained starting from the zero portfolio. This is intimately related to self-financing portfolios.[citation needed]

The dual cone of the solvency cone (

) are the set of prices which would define a friction-less pricing system for the assets that is consistent with the market. This is also called a consistent pricing system.[1]

) are the set of prices which would define a friction-less pricing system for the assets that is consistent with the market. This is also called a consistent pricing system.[1]Examples

Assume there are 2 assets, A and M with 1 to 1 exchange possible.

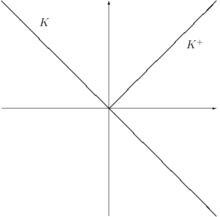

Frictionless Market

In a frictionless market, we can obviously make (1A,-1M) and (-1A,1M) into non-negative portfolios, therefore

. Note that (1,1) is the "price vector."

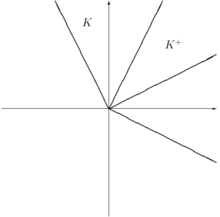

. Note that (1,1) is the "price vector."With Transaction Costs

Assume further that there is 50% transaction costs for each deal. This means that (1A,-1M) and (-1A,1M) cannot be exchanged into non-negative portfolios. But, (2A,-1M) and (-1A,2M) can be traded into non-negative portfolios. It can be seen that

.

.The dual cone of prices is thus easiest to see in terms of prices of A in terms of M (and similarly done for price of M in terms of A):

- someone offers 1A for tM:

therefore there is arbitrage if

therefore there is arbitrage if

- someone offers tM for 1A:

therefore there is arbitrage if t > 2

therefore there is arbitrage if t > 2

Note

If a solvency cone K:

- contains a line, then there is an exchange possible without transaction costs.

, then there is no possible exchange.

, then there is no possible exchange.

References

- ^ a b Schachermayer, Walter (November 15, 2002). The Fundamental Theorem of Asset Pricing under Proportional Transaction Costs in Finite Discrete Time.

- ^ Hamel, Andreas; Heyde, Frank (December 11, 2008) (pdf). Duality for Set-Valued Risk Measures. http://www.princeton.edu/~ahamel/SetRiskHamHey.pdf. Retrieved July 22, 2010.[dead link]

Categories: - someone offers 1A for tM:

Wikimedia Foundation. 2010.