- Office of Federal Student Aid

-

Federal Student Aid, an office of the U.S. Department of Education, plays a central and essential role in America's postsecondary education community. Some of the most visible and essential services are the development, distribution, and processing of the Free Application for Federal Student Aid (FAFSA), the fundamental qualifying form used for all federal and government-guaranteed commercial lenders' programs—as well as for many state, regional and private student aid programs. By filling out the online or paper FAFSA, applicants start the process of qualifying for aid. Each year FSA's staff processes approximately 14 million FAFSAs.

Contents

Mission

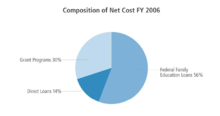

Federal Student Aid's (FSA) core mission is to ensure that all eligible Americans benefit from federal financial assistance—grants, loans and work-study programs—for education beyond high school. The programs they administer comprise the nation's largest source of student aid: during the 2004-05 school year alone, FSA provided approximately $74 billion in new aid to nearly 10 million postsecondary students and their families. A staff of 1,100 is based in 10 cities in addition to their Washington headquarters.

While overseeing $448 billion of outstanding student loans, FSA ensures that all partners in the student aid community—schools, lenders, servicers and guaranty agencies—operate fairly, honestly and efficiently. Another key role they perform is to make students and their families aware that financial aid is available and is a necessary first step to further education. They distribute numerous publications, host multiple Web sites and run several customer call centers. Most of these services are provided in Spanish as well.

The Federal Student Aid team is committed to making education beyond high school more attainable for all Americans, regardless of socioeconomic status.

Student Aid

Federal Student Aid is financial help for students enrolled in eligible programs at participating schools to cover school (a four-year or two-year public or private educational institution, a career school or trade school) expenses, including tuition and fees, room and board, books and supplies, and transportation. Most federal aid is need-based. The three most common types of aid are grants, loans, and work-study.

Grants are a type of financial aid that does not have to be repaid. Generally, grants are for undergraduate students and the grant amount is based on need, cost of attendance, and enrollment status.

- Federal Pell Grants are designed for low- and middle-income undergraduate students. Pell Grants for the 2006-2007 school year range from $400 to $4,050.

- The Federal Supplemental Educational Opportunity Grant (FSEOG) is a program in which Federal Student Aid provides funds to schools, who in turn offer the grant to students. FSEOG grants range from $100 to $4,000 during the 2006-2007 school year.

- The Academic Competitiveness Grant (ACG) is for full-time undergraduate students. First-year students may receive up to $750, while second-year students may receive up to $1,300.

- The Science and Math Access to Retain Talent (SMART) Grant provides up to $4,000 for third- and fourth-year full-time undergraduate students who are studying physical, life or computer sciences, mathematics, technology, engineering, or a foreign language critical to national security.

Loans are borrowed money that must be repaid with interest. Both undergraduate and graduate students may borrow money. Parents may also borrow to pay education expenses for dependent undergraduate students. Maximum loan amounts depend on the student's year in school.

- Federal Stafford Loans are made to students and PLUS Loans are made to parents through two loan programs:

- William D. Ford Federal Direct Loan (Direct Loan) Program: Eligible students and parents borrow directly from the federal government at participating schools. Direct Loans include Direct Stafford Loans, Direct PLUS Loans, and Direct Consolidation Loans.

- Federal Family Education Loan (FFEL) Program: Private lenders provide federally guaranteed funds. FFELs include FFEL Stafford Loans, FFEL PLUS Loans, and FFEL Consolidation Loans. As of July 1, 2010, the FFEL Program ended.

Campus-Based Aid are types of federal aid in which the school and Federal Student Aid share in the cost of providing the aid. The school provides a portion and the federal government provides the remainder. The school is responsible for administering the program on behalf of the federal government.

- Federal Perkins Loans are offered by participating schools to provide students who demonstrate the most need with low-interest loans.

- Work-study allows students to earn money while enrolled in school in order to help pay for education expenses.

Sources

Links

- ED.gov

- FAFSA.ed.gov

- Students.gov

- "College, Inc.", PBS FRONTLINE documentary, May 4, 2010

Agencies under the United States Department of Education Secretary of Education

Deputy Secretary of Education Office of Safe and Drug Free Schools · Office of Innovation and Improvement · Office of Special Education and Rehabilitative Services · Office of English Language Acquisition · Office of Elementary and Secondary EducationUnder Secretary of Education Office of Federal Student Aid · Office of Vocational and Adult Education · Office of Postsecondary Education · White House Initiative on Historically Black Colleges and UniversitiesPrograms Independent Organizations Advisory Committee on Student Financial Assistance · National Institute for Literacy · National Assessment Governing Board · National Board for Education Sciences · White House Initiative on Tribal Colleges and Universities · White House Initiative on Educational Excellence for HispanicsCategories:- United States Department of Education agencies

Wikimedia Foundation. 2010.