- Magnetar Capital

-

Magnetar Capital is a hedge fund based in Evanston, Illinois. Among its many activities, the firm was actively involved in the collateralized debt obligation (CDO) market during the 2006–2007 period. In some articles critical of Magnetar Capital, the firm's arbitrage strategy for CDOs is described as the Magnetar trade.

Contents

History

Magnetar Capital was founded in 2005 by Alec Litowitz (formerly of Citadel LLC) and Ross Laser (formerly of Glennwood Capital Partners). It is based in Evanston, Illinois.[1]

In 2006, Magnetar Capital began to buy large amounts of equity tranches in CDO deals. Partner David Snyderman (also formerly of Citadel LLC) told Derivatives Week at the time that Magnetar Capital was "excited about the opportunities in the mortgage derivatives market".[1] From 2006-2007 Magnetar Capital sponsored (bought the equity tranche) of about $30 billion dollars worth of CDOs.[2] Many of the CDOs were named after stars or constellations.

Around 2006, Magnetar Capital received marketing from Goldman Sachs regarding "short bets" against the housing market via an Asset-backed securities index (ABX).[3]

In 2006, Andrew Sterge (formerly of Cooper Neff Group, BNP Paribas) brought his team from AJ Sterge Investments to work for Magnetar Capital [4] Magnetar also hired Michael Gross of Apollo Management.[5]

In 2006, Magnetar Capital started a reinsurance company called Pulsar Re.[4]

In 2006, a team at Calyon bank participated in multiple deals involving Magnetar Capital CDOs. The team, led by Alexander Rekeda, left Calyon for the Mizuho bank in late 2006. In 2007, Mizuho did more CDO deals with Magnetar Capital.[6][7][8][9]

In 2007, Magnetar participated in a series of CDO deals with GSC Partners and JP Morgan Chase. They would later become the center of an Securities and Exchange Commission case against JP Morgan.[10][11]

In October 2007, Magnetar Capital set up a Credit Derivatives Product Company (CDPC) named Quadrant Structured Credit Products, with Lehman Brothers. Employees included Gene Park (formerly of AIG), Martin Nance, and others. Fitch Ratings rated it AAA in October 2007 and withdrew its rating in October 2008. In December 2008, Quadrant bought competitor Cournot. Moody's withdrew its rating in February 2009.[12][13][14][15][16][17]

As of 2010, 23 of the CDOs sponsored by Magnetar Capital had become "nearly worthless".[18][19]

In the press

Several journalists and writers have reported on the Magnetar Capital CDO program. Janet Tavakoli says that she covered the strategy itself in her book of 2003, before Magnetar Capital was founded.[20] In 2006 Derivatives Week did a story on the strategy. In 2008 Carrick Mollenkamp and Serena Ng of the Wall Street Journal reported on the large losses of CDOs linked to the fund. In mid 2010 two more indepth analyses appeared, one a joint effort between NPR and ProPublica, and another in the book EConned by Yves Smith, in connection with her website nakedcapitalism.com

ProPublica / NPR / This American Life report

In 2010 This American Life, of Chicago Public Radio, broadcast a radio show on Magnetar Capital's CDO strategy. The report was by Alex Blumberg, of the NPR Planet Money project. The report consisted largely of Blumberg's interviews with Jesse Eisinger and Jake Bernstein, of ProPublica, whom Blumberg had commissioned to research possible financial misdeeds related to the subprime housing bubble. Eisinger and Bernstein interviewed dozens of people who had worked in the industry and many who were directly involved in Magnetar Capital deals. [21]

Eisinger and Bernstein won the Pulitzer Prize of 2011 for their series on the CDO industry. It was the first Pulitzer for work published only on the web.

ProPublica's written story came out on their website in April 2010, coinciding with the radio show. It alleged that the company's trades in the CDO market helped worsen the financial crisis of 2007–2010 by helping to structure CDOs it was planning to short (bet against).[21]

The story essentially claimed that Magnetar Capital "sponsored" mortgage-backed collateralized debt obligations by agreeing to buy the worst tranche (portion) of the CDO, the "equity tranche". Since very few wanted to invest in the risky Equity Tranche, those few that did were called "sponsors"; without them the CDO would never get created. The ProPublica stories claimed that Magnetar Capital then shorted (bet against) the better tranches of those (and similar) CDOs by buying credit default swaps that insured them. When the middle tranches of the CDOs failed, Magnetar Capital made back many times its initial investment in the equity tranche by receiving the insurance payoff.[18][22]

The report also claimed that Magnetar Capital tried to influence the managers of the CDOs it was instrumental in creating, to buy certain risky bonds that would increase the risk of those CDOs failing. It also claims that Magnetar Capital CDOs "defaulted" at a significantly higher rate than similar CDOs. (This may reflect Magnetar Capital's superior performance in identifying which of the "high-quality" tranches were most overpriced.) They also claim that the CDO market would have "cooled off" in late 2005 if Magnetar Capital had not entered the market, and that this would have resulted in the financial crisis being less severe.[18][23][24]

Magnetar Capital's Response

Magnetar Capital disputed the story. Many of its responses were explained in ProPublica's story and in a detailed letter Magnetar Capital sent to ProPublica, posted on ProPublica's website. Magnetar Capital said, among other things, that it was not betting, it was hedging, that most of its hedges were against non-Magnetar-Capital CDOs, and that it was not making CDOs that were "built to fail" on purpose. It also claimed that its strategy was not based on a downturn in the housing market (that is, it did not bet that mortgage-backed CDOs would default). It detailed many of its objections in a letter and list of responses to ProPublica, which are linked to on ProPublica's website.[25][26]

Magnetar Capital stated to investors that it never sought to bet on the decline of the subprime-mortgage market.[27] Rather, the firm states, it had no embedded view regarding the direction of housing prices, the rate of mortgage defaults, or the subprime mortgage market generally. Instead, Magnetar Capital claimed it sought to profit from arbitrage: its perception that the riskiest, high-yield tranches of CDOs were underpriced relative to the less-risky low-yield tranches. The firm expected to make a profit when either the overpriced securities declined or when the underpriced securities appreciated. With the collapse of the subprime market, Magnetar Capital lost money on the risky tranches but made a net profit because the overpriced tranches declined even further. Magnetar Capital rejected the idea that it had picked securities purposely so that they would fail. [2][18][28][22][25][26]

The theory is that Magnetar Capital was essentially betting that the likelihood of multiple defaults on the underlying loans was more likely than was reflected in the price of the higher tranches. The high prices of the "high-quality" tranches reflected the assumption that any defaults would be localized and unrelated, so that it was unlikely that much of the portfolio would default at once. Magnetar Capital was betting that, in all likelihood, if the equity tranch lost its value, the rest of the CDO would lose value as well, because many defaults were likely to happen together. This is what, in fact, happened.[citation needed]

Magnetar Capital also disparaged the reporters, stating that "the questions we received from you [the ProPublica reporters] last week, and the assertions reflected in those questions, reflect significant inaccuracies or misunderstandings regarding aspects of Magnetar Capital’s investment strategy".[26]

Later, Magnetar Capital wrote a letter to its investors, rebutting many of the claims in the ProPublica story. IE:

"we wanted to address the recent publicity regarding our Mortgage CDO investment strategy. At the center of these stories is a blatantly false and misleading story written by ProPublica, an online news outlet, regarding our Mortgage CDO investment strategy that was active from 2006 through 2007. Despite our best efforts to educate ProPublica’s reporters about the specifics of Magnetar Capital’s Mortgage CDO investment strategy as well as the general process and market circumstances regarding the structuring and issuance of CDOs, ProPublica simply got the story wrong." [29]

Counter Response

ProPublica's editor-in-chief, Paul Steiger, responded to Magnetar Capital's letter and wrote:

"Magnetar’s letter doesn’t deny that it purchased collateralized debt obligation (CDO) equity, that it bet against many of those CDOs, or that it exercised influence over the construction of the portfolios. In particular, it doesn't deny and in one case admits that it pushed for higher returns and hence greater risk in the portfolios...In short, we see nothing in our story to correct."

ProPublica continued to publish articles on Magnetar Capital throughout 2010 and 2011. Although arbitrage is recognized as leading to price convergence, ProPublica continues to insist the opposite in this case—that Magnetar Capital is responsible for price distortions in the CDO market.

Naked Capitalism / EConned

Yves Smith of the nakedcapitalism.com, along with other bloggers at that site, also worked on describing and analyzing Magnetar Capital's CDO program.

Smith also wrote a book, EConned, which contains a detailed description of Magnetar Capital's activities. It cites anonymous sources affiliated with institutions that did business with Magnetar Capital. Her research was gathered in October 2009 and the book came out in March 2010.[30][31] The book goes into detail surrounding the motives of the various parties and the numbers involved that made the deal profitable. It also describes the large size of Magnetar Capital's play in proportion to the subprime market as a whole. The book gives a larger context for the Magnetar Capital arbitrage, fitting into Smith's thesis of the modern science of economics being largely a failure.[32]

Smith and the nakedcapitalism.com bloggers continued to post articles regarding Magnetar Capital throughout 2010. They also produced a spreadsheet analyzing the Magnetar Capital CDOs, similar to the one found at ProPublica.[33][34]

Senate Report of 2011

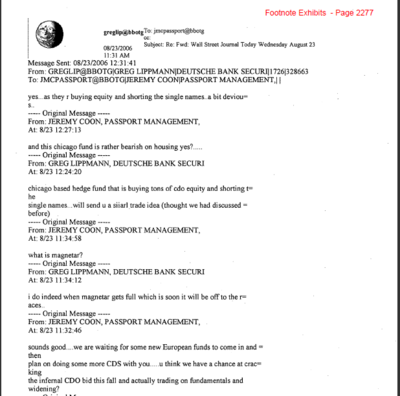

In April, 2011, the United States Senate released the Levin-Coburn report on "Wall Street and the Financial Crisis". Their report went in depth into the activities of Greg Lippman, the head global CDO trader of Deutsche Bank. He was a CDO expert, and worked at the heart of the Synthetic CDO market during the credit bubble. He also is featured in the book The Big Short by Michael Lewis; it describes his attempts to sell "short positions" on the mortgage security market to hedge funds.

In the report transcript, Lippman describes Magnetar Capital's strategy of shorting one part of the CDO while buying the other; he also writes about what he thinks their view of the housing market is. When asked if they are "bearish on housing", he says that "yes…as they r buying equity and shorting the single names…a bit devious".

In another email, someone asks him how Magnetar Capital has distorted the market. In the report transcript, no explanation is provided; Lippman indicates only that he has an "easy, but lengthy answer".

See also

- List of CDO managers

- Goldman Sachs: Abacus mortgage-backed CDOs

- Merrill Lynch: CDO controversies

- Subprime mortgage crisis

- Tricadia Capital

References

- ^ a b Abigail Moses (2006 8 14). "Reach for the Stars: Ill. Fund Swallows Big Chunk of Synthetic ABS" (pdf). Derivatives Week. http://www.derivativesweek.com/pdf/DW081406.pdf. Retrieved 2010 5 1.

- ^ a b "A Fund Behind Astronomical Losses" Carrick Mollenkamp and Serena Ng, 2008 2 13, The Australian (reprint of an article that had appeared in the Wall Street Journal)

- ^ Banks Bundled Bad Debt, Bet Against It and Won by Gretchen Morgenson and Louise Story, 23 December 2009, New York Times

- ^ a b Magnetar adds Sterge for reinsurance, efinancialnews.com, Jennifer McCandless, 2006 7 25, accessed 2010 5 1

- ^ Apollo’s Gross joins Magnetar as co-chairman, Jennifer McCandless, 2006 7 27 , accessed 2010 5 1

- ^ ProPublica's Timeline of Magnetar deals, 9 April 2010, Jake Bernstein, Jesse Eisinger and Krista Kjellman Schmidt. accessed 2010 5 7

- ^ Mizuho $7 Billion Loss Turned on Toxic Aardvark Made in America, By Finbarr Flynn, Oct 28, 2008, Bloomberg, accessed 2010 5 7

- ^ Rekeda Joins Guggenheim as CDO Head By ASR Staff March 3, 2008 structuredfinancenews.com, accessed 2010 5 7

- ^ Article: Mizuho Nabs Calyon CDO Staffers, Bank Loan Report, Dec 18, 2006, Pyburn, Allison, via highbeam.com. accessed 2010 5 7

- ^ SEC.gov

- ^ Blogs.wsj.com

- ^ Derivatives Week, Oct 22 2007, Quadrant CDPC Plots Wide Remit

- ^ Fitch Rates Quadrant Structured Credit Products LLC 'AAA'., Business Wire , 2007 10 12, accessed 2010 5 3

- ^ Fitch Withdraws CDPC Ratings Business Wire 2008, accessed 2010 5 3

- ^ Moody's withdraws ratings on Quadrant Structured Credit Products LLC, Moody's Global Credit Research , Feb 02, 2009 , accessed abstract of article, 2010 5 3, via alacrastore.com

- ^ SCI Bulletin: CDPC acquired by competitor, Structured Credit Investor. 4 December 2008, accessed abstract via google search, 2010 5 3

- ^ About ARIS, Martin J. Nance, aris-corporation.com, accessed 2010 5 3

- ^ a b c d "The Inside Job. Act One: Eat My Shorts" (Episode 405), This American Life. (2010-04-09), Alex Blumberg, Jake Bernstein, Jesse Eisinger

- ^ The "nearly worthless" comment is at 36:40 into the This American Life "Inside Job" audio story

- ^ ProPublica's (and NY Times') "Untold" Magnetar Story Creates Excuses for Wall Street and Washington , Janet Tavakoli, 2010 4 19, huffingtonpost.com

- ^ a b The Magnetar Trade: How One Hedge Fund Helped Keep the Bubble Going, by Jesse Eisinger and Jake Bernstein, ProPublica, April 9, 2010

- ^ a b The Anatomy of the Magnetar Trade, ProPublica. Graphic by Irwin Chen, Redub LLC

- ^ They hired PF2 Securities Evaluations to analyze the CDOs. A link is in their story

- ^ The "cool off" claim is at 36:15 into the This American Life "Inside Job" audio story.

- ^ a b Magnetar's Letter in Response, ProPublica.org, April 6, 2010.

- ^ a b c Magnetar's response to our questions, ProPublica.org, April 6, 2010.

- ^ Patrick, Margot (2010-04-20). "Magnetar Says It Didn't Help Create CDOs "Built To Fail"". The Wall Street Journal. http://online.wsj.com/article/SB10001424052748704448304575196092506453712.html?mod=WSJ_business_whatsNews.

- ^ Mollenkamp, Carrick; Serena Ng (December 7, 2007). "Wall Street Wizardry Amplified Credit Crisis: A CDO Called Norma Left "Hairball of Risk"; Tailored by Merrill Lynch". The Wall Street Journal. http://online.wsj.com/article/SB119871820846351717.html.

- ^ Magnetar Denies Creating Faulty C.D.O.’s Michael J. de la Merced, 2010 4 20, New York Times (Dealbook blog), accessed 2010 4 22. Magnetar Capital's letter to investors is linked off of this article.

- ^ Amazon.com

- ^ Nakedcapitalism.com

- ^ See EConned, by Yves Smith, published by Palgrave MacMillan, 2010

- ^ Doth Magnetar Speak with Forked Tongue? By Tom Adams, Andrew Dittmer, Richard Smith, and Yves Smith, nakedcapitalism.com, 2010 4 15

- ^ Magnetar, Goldman Press Flurry Still Misses the Biggest Point of All by Andrew Dittmer and

External links

Categories:- Companies established in 2005

- Hedge funds

- Companies based in Evanston, Illinois

Wikimedia Foundation. 2010.