- Indian Chartered Accountancy Course

-

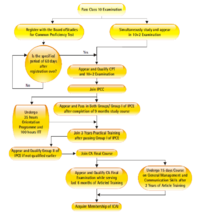

The Indian Chartered Accountancy Course is the membership qualification course offered by the Institute of Chartered Accountants of India (ICAI). Any person who wants become a member of ICAI and designate himself as a Chartered Accountant in India has to pass this course. This course is a optimum blend of practical and theoretical education. It consists of three levels of examinations and three years of practical training under a practising Chartered Accountant. The Chartered Accountancy course is considered to be one of the rigorous professional courses in India but not difficult if one puts his fullest efforts.[1]

Contents

CPT

The CPT or Common Proficiency Test is the first level of Chartered Accountancy examinations. It is an objective type examination and consists of 200 multiple choice questions. CPT covers four basic subjects viz. Fundamentals of Accounting, Mercantile Laws, Economics and Quantitative Aptitude. A person can register for CPT after completing Grade 10 and take the exam after completing High School (Grade 12). Every incorrect answer on the CPT exam carries a 0.25 negative mark. The passing grade for CPT is 100 marks out of 200. CPT exams are held in June and December in paper pencil mode. On-line CPT exams are also conducted periodically.

IPCC

IPCC or Integrated Professional Competence Course is the second level of Chartered Accountancy examinations. A person can take the IPCC Examination after passing CPT and nine months of study. IPCC has two groups of seven subjects. Group - I consists of four subjects and Group - II of three subjects. A passing grade is awarded if the candidate obtains 40% marks in each subject and 50% in the aggregate in each group.

Final

CA Final Examination is the last and final level of Chartered Accountancy Examinations. Any person who has passed both the groups of IPCC, during the last six months of articleship can take the Final Examination. This exam consists of two groups of four subjects each viz. Financial Reporting, Strategic Financial Management, Advanced Auditing and Professional Ethics, Corporate and Allied Laws, Advanced Management Accounting, Information Systems Control and Audit, Direct Tax Laws and Indirect Tax Laws. A passing grade is awarded if the candidate obtains 40% marks in each subject and 50% in the aggregate in each group.

ICAI conducts CPT exams in June and December, IPCC and Final examinations in May and November each year. Examinations are conducted in major cities in India and other countries such as Abu Dhabi (U.A.E.), Dubai (U.A.E.) and Kathmandu (Nepal). ICAI updates content and format of examinations periodically in keeping with technical progress and changes in practice of the profession. The ICAI last revised its training course for membership in 2008.[2]

Articled and industrial training

After passing Group - I of IPCC, a candidate must undergo a rigorous 3 year on-the-job training as article or audit assistant, articleship. Only members in practice are entitled to engage such assistants. The Institute strictly governs through Regulations, the stipends, working hours and working conditions of such assistants. Articles provide CA firms a steady supply of motivated assistants while providing the students with invaluable on-the-job training. Audits are normally conducted by partnering senior and junior assistants with a supervising partner of the firm. This provides steady increase in the depth and variety of experience to the Articled Assistants. During the last year of articleship, a student may opt for industrial training instead. Industrial training can be for a period of 9 to 12 months and has to be completed under the supervision of an existing CA member employee of a financial, commercial or industrial organization. Over the years several cases of abuse of the system such as articles being made to work long hours, work without pay/delayed payments, or being made to perform personal tasks for their Principals, some faking their training (also called dummy articles, i.e. not going to the office but spending time studying at home or in coaching classes) led the institute to start enforcement of rules and regulations in the interest of the profession.[3] Chartered Accountants may not provide coaching classes during working hours, as students are expected to apply themselves wholly to practical training in that time.[4] An article may complain to the Disciplinary Committee against a member or firm for non-compliance with regulations.

GMCS

General Management and Communication Skills Course or GMCS is a 15 day mandatory course and was introduced in 2002 to improve business communication, presentation and interpersonal skills of Chartered Accountants. Completion of the course is a pre-requisite for obtaining membership and can be taken during the last 12 months of Articleship, after completing the IPCC examinations.

References

- ^ "Rigorous, but not difficult". The Hindu (Education Plus Karnataka). 11 October 2010. http://www.hindu.com/edu/2010/10/11/stories/2010101150810100.htm. Retrieved 12 March 2011.

- ^ ICAI Board of Studies Announcement of the new scheme of education, 2008.

- ^ Working Hours for Article Assistants

- ^ ICAI notification against coaching classes during office hours, 28 January 2010

Categories:- Accounting in India

- Distance education in India

- Accountancy qualifications

Wikimedia Foundation. 2010.