- Poverty in Canada

Poverty in

Canada remains prevalent with some segments of society. The measurement ofpoverty has been a challenge as there is no official government measure. There is an ongoing debate in Canada about whether a relative measure of poverty, or absolute measure of poverty, is more valid.Currently, an income inequality measure known low income cut-off published by Statistics Canada is frequently used as a poverty rate and is 10.8% as of 2005. [http://www.cbc.ca/news/background/economy/poverty-line.html Poverty Measure in Canada Analysis] , CBC, URL accessed 4 January 2007] It is used by by statistics collators like the

Central Intelligence Agency in lieu of an official measure, noting that a relative measure results in a higher poverty figure than an absolute one. The Fraser Institute, aconservative andlibertarian think-tank, publishes an absolute measure known as the basic needs poverty measure. According to this measure, poverty has declined significantly over the past 60 years and is 4.9% as of 2004. [http://www.fraserinstitute.org/COMMERCE.WEB/product_files/PovertyinCanada2006.pdf Poverty in Canada: 2006 Update] ,Fraser Institute , November 2006, URL accessed 3 December 2007] Statistics Canada has refused to endorse any metric as a measure of poverty, including the low-income cut off it publishes, without a mandate to do so from the federal government.Some Canadian elements that work towards reducing poverty in Canada include Canada's strong economic growth, government transfers to persons of $134.8 billion per annum as of 2005 [http://www40.statcan.ca/l01/cst01/govt05a.htm Government transfer payments to persons] ,

Statistics Canada , 8 November 2007, URL accessed 4 December 2007] , universal medical andpublic education systems, a progressive income tax system, andminimum wage laws in each of theprovinces and territories of Canada .In recent times, after a spike in poverty and low-income rates around the 1996 recession, relative poverty has continued to decline. Certain groups experience higher low-income rates. These include families with single-parent mothers, autistics, aboriginals, the mentally ill, the physically handicapped, recent immigrants, and students. Effects of poverty include poor health, substance abuse, homelessness, crime, and suicide. [http://dissemination.statcan.ca/english/research/11F0019MIE/11F0019MIE2003198.pdf The rise in low-income rates among immigrants in Canada] , Analytical Studies Branch research paper series,

Statistics Canada , June 2003, URL accessed 20 September 2006] [http://www.statcan.ca/english/research/11F0019MIE/11F0019MIE2007294.pdf Chronic Low Income and Low-income Dynamics Among Recent Immigrants] ,Statistics Canada , January 2007, URL accessed 30 January 2007]History of poverty in Canada

Canada's history is marked by identified periods of growth and

recession , and an evolving response of government intervention to assist low-income Canadians.Reflecting the practice in the

British Isles , organized assistance to the poor was largely the realm of churches. [http://www.google.ca/url?sa=t&ct=res&cd=1&url=http%3A%2F%2Fwww.shillington.ca%2Fpoverty%2FPoverty_a_short_history.pdf&ei=w_5SR_HaFZy0hALa24TbCg&usg=AFQjCNEL4_W0752PWUUc8Il93lA22D3MaA&sig2=VkUMzyzn8b2N3CXsbcapKg Poverty - A short history] ,Tristat Resources , URL accessed 2 December 2007] In the early 20th century, theCatholic Encyclopedia reported that there were eighty-seven hospitals in Canada under the control and direction of various Catholic religious communities. [http://www.newadvent.org/cathen/12327a.htm Poverty and Pauperism] ,Catholic Encyclopedia , URL accessed 2 December 2007]After the

Great Depression , Bennett and Mackenzie King spurred the first stages of Canada's welfare state, and the size and role of the government began to grow immensely over the next decades. Many social programs developed during this time designed to increase the Canadian citizen's quality of life.In recent years, immigrants have experienced higher than normal low-income rates.

: "See also,

Economic history of Canada andThe Great Depression in Canada "Measures of poverty in Canada

: "See related article,

Measuring poverty "Canada has no official poverty measure because Statistics Canada has stated that unless politicians express a social consensus on the definition of poverty, there will be no measure because they feel that it is not Statistics Canada's role to determine what constitutes a necessity. [http://www.statcan.ca/english/research/13F0027XIE/13F0027XIE1999001.htm On poverty and low income] ,Statistics Canada , 1997, URL accessed 2 December 2007] There is a debate on whether an absolute or relative measure is more valid.Absolute poverty measure

: "See related article,

Basic needs "The basic needs poverty measure is the only metric in Canada designed to be an absolute poverty, orpoverty threshold measure. It was developed in 1992 under the auspices of the conservative and libertarian Fraser Institute by economist Chris Sarlo. [ [http://www.fraserinstitute.org/commerce.web/author_detail.aspx?authID=713 Biography - Chris Sarlo] , Fraser Institute website] According to the latest update "the basic-needs approach is partly absolute (the list [of necessities] is limited to items required for long-term physical well-being) and partly relative, reflecting the standards that apply in the individual's own society at the present time." [http://www.fraserinstitute.org/COMMERCE.WEB/product_files/PovertyinCanada2006.pdf Poverty in Canada: 2006 Update] ,Fraser Institute , November 2006, URL accessed 3 December 2007]The measure is based on various data sources including Statistics Canada's databases (for example Survey of Household Spending) and CMHC housing information to determine the cost of a list of household necessities (

food , shelter,clothing ,health care , personal care, essential furnishings,transportation andcommunication ,laundry ,home insurance , and miscellaneous) for various communities across Canada and then, based on family size, determines how many households have insufficient income to afford those necessities. Before 2004, the determination of the poverty rate was based on pre-tax income inclusive of government social program income such as welfare, employment insurance, and old-age pensions. Taxes were not particularly relevant as households at or beneath the poverty rate would pay little or no income tax. More recently, the after-tax incomes have been used as the indicator of household well-being. Like most measures, it is based on reported income and is therefore subject to error related tounreported employment and theunderground economy .The measure is based on various sources of historical income data. The basic needs poverty rate has fallen dramatically over the past 51 years, and as of 2004, was 4.9%, representing 1.6 million Canadians. [http://www.fraserinstitute.org/COMMERCE.WEB/product_files/PovertyinCanada2006.pdf Poverty in Canada: 2006 Update] ,

Fraser Institute , November 2006, URL accessed 3 December 2007]Relative poverty measures

: "See related articles,

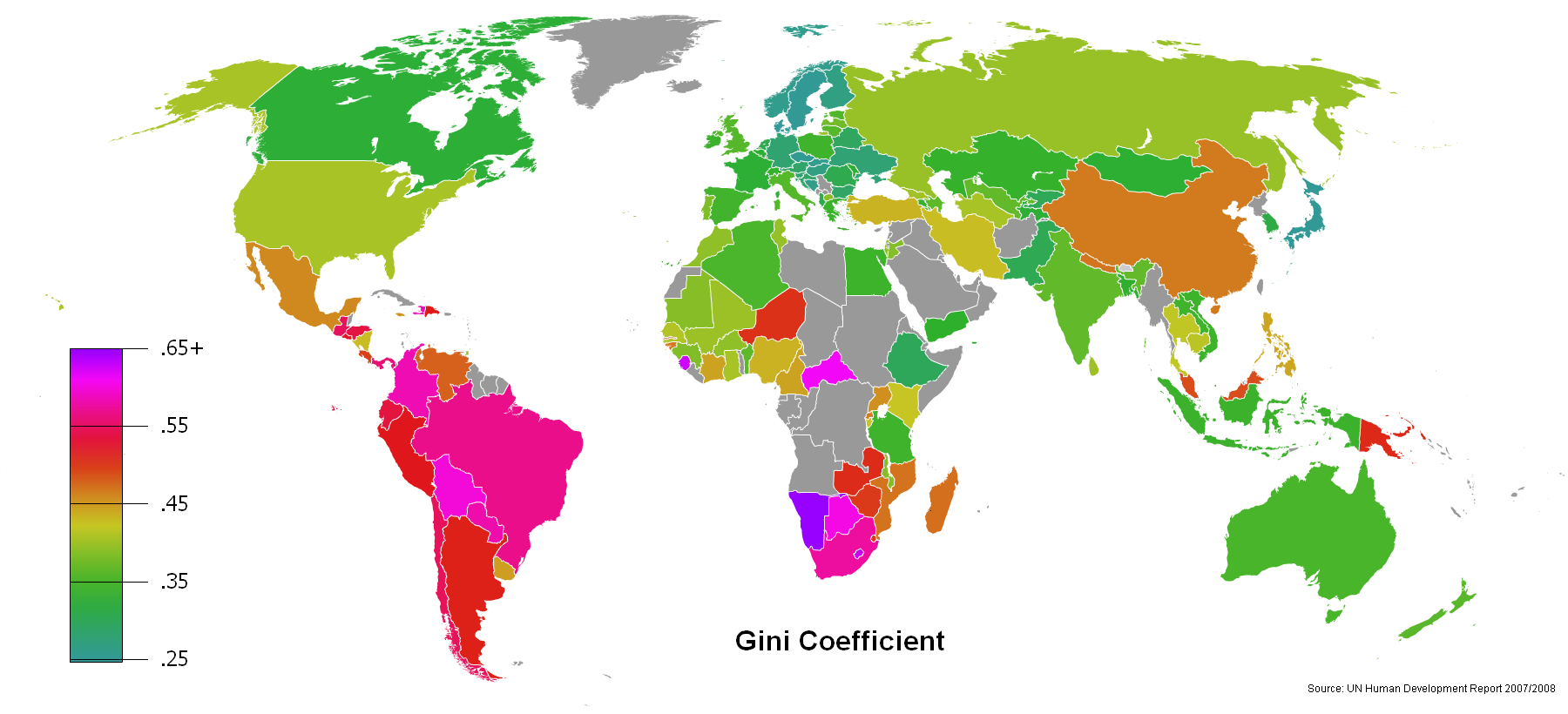

Economic inequality ,Income inequality metrics , andRelative deprivation "Relative poverty measures, the most prominent being income distribution measures, also known as income inequality metrics, reveal information about disparities of income within a population. In lieu of an official poverty measure, the LICO is regarded as a poverty measure by various groups. It has been referred to as "the most accepted measure" of poverty. [http://www.cbc.ca/news/background/economy/poverty-line.html Poverty Measure in Canada Analysis] , CBC, URL accessed 4 January 2007] Internationally, the Gini coefficient is a prominent income distribution metric.

Low-income cut-off (LICO)

Low-income cut-off (LICO) rates are often quoted by the media as a measure of poverty [http://www.cbc.ca/news/background/economy/poverty-line.html Poverty Measure in Canada Analysis] , CBC, URL accessed 4 January 2007] even though Statistics Canada has stated it is not a poverty measure. [http://www.statcan.ca/english/research/13F0027XIE/13F0027XIE1999001.htm On poverty and low income] ,

Statistics Canada , 1997, URL accessed 2 December 2007] It is also used by statistics collators like theCentral Intelligence Agency in lieu of an official measure, although the CIA also notes that it "results in higher figures than found in many comparable economies." [ [https://www.cia.gov/library/publications/the-world-factbook/fields/2046.html Population below poverty line] ,The World Factbook ,CIA , updated onMarch 20 2008 .]The measure has been reported by Statistics Canada since the 1960s. [http://www.ccsd.ca/pr/lico00aj.htm What's behind a poverty line?] , Canadian Council on Social Development, 9 June 2000, URL accessed 2 December 2007 ] They were reported only in their "pre-tax" form until 2000, at which point Statistics Canada started to publish both pre and after-tax LICO rates. After-tax LICO rates have been retroactively calculated back to 1986. The measure is intended to represent an income threshold below which a family will likely devote a larger share of its income on the necessities of food shelter and clothing than the average family. [http://www.statcan.ca/english/research/75F0002MIE/75F0002MIE2006004.pdf Low Income Cut-offs for 2005 and Low Income Measures for 2004] ,

Statistics Canada , 2006, URL accessed 2 December 2007] As of 2005, 10.8% of Canadians are in a family whose income is below the after-tax low-income cut-off.There are 7 family sizes and 5 community sizes, resulting in 35 total LICO groups, each one evaluated on a pre and after-tax basis (70 calculations in total). The LICO is currently set at 63% of the average family income within each group. This stems from the 1992 Family Expenditures Survey, which showed the average family spent 43% of its after-tax income on food, shelter and clothing, plus Statistics Canada added an additional 20% margin.

Statistics Canada prefers using the after-tax LICO over the pre-tax LICO "to draw conclusions about [families] overall economic well-being"; [http://www.statcan.ca/english/freepub/75F0011XIE/2004001/notes_lowincome.htm Low income definitions] ,Statistics Canada , 2005, URL accessed 2 December 2007] however, the pre-tax measures are needed depending on the study being conducted because some sources of data, such as the census, contain only pre-tax income information. It can also be useful to know the pre-tax income profile of groups before the effects of progressive tax rates.Gini coefficient

thumb|right|500px|Gini coefficient, income distribution by country. : "See main article,Gini coefficient "The Gini coefficient is a measure of statistical dispersion most prominently used as a measure of inequality of income distribution or inequality of wealth distribution. It is defined as aratio with values between 0 and 1: the numerator is the area between theLorenz curve of the distribution and the uniform distribution line; the denominator is the area under the uniform distribution line. Thus, a low Gini coefficient indicates more equal income or wealth distribution, while a high Gini coefficient indicates more unequal distribution. 0 corresponds to perfect equality (everyone having exactly the same income) and 1 corresponds to perfect inequality (where one person has all the income, while everyone else has zero income). The Gini coefficient requires that no one have a negative net income or wealth.Serious consideration of the Gini coefficient for public policy implications is rare in Canada. Discussion of income inequality in the Canadian media generally implies that income inequality should be continually reduced as an objective, whereas international economists evaluating Gini coefficients generally focus on the idea of targeting an optimal range for the Gini coefficient. Some researchers have suggested the optimal Gini coefficient range is about .25-.40 (Wolfgang Kitterer, 2006, "More Growth through Redistribution?"). As of 2004, the Gini coefficient for Canada was estimated to be 0.315 on an after-tax basis. [http://www.statcan.ca/english/research/11F0019MIE/11F0019MIE2007298.htm Income Inequality and Redistribution in Canada: 1976 to 2004] ,

Statistics Canada , 11 May 2007, URL accessed 2 December 2007]Poverty Reduction

Several Canadian provinces are introducing poverty reduction strategies, following the examples set by the European Union, Ireland and the United Kingdom. Newfoundland & Labrador, Nova Scotia, Quebec, Ontario and Manitoba are all developing provincial strategies. Quebec and Manitoba have enshrined their efforts in legislation. Newfoundland & Labrador has established a provincial ministry. Ontario has set a cabinet roundtable to address child poverty, as per the Liberal's campaign promise.

Because of these moves, each province is exploring the development of a measurement tool to track any progress made on reducing poverty, such as the use of a "Deprivation Index".

Assistance for poor people in Canada

Government transfers and intervention

Reduced tax burden

:"See related article,

Income taxes in Canada "The Canadian income tax system is highly progressive. This can be seen by comparing the 2005 pre-tax low-income cut-off rate of 15.3% [http://www40.statcan.ca/l01/cst01/famil41a.htm Persons in low income before tax, by prevalence in percent] ,Statistics Canada , 1 May 2007, URL accessed 4 December 2007] with the after-tax rate of only 10.8%. [http://www40.statcan.ca/l01/cst01/famil19a.htm Persons in low income after tax, by prevalence in percent ] ,Statistics Canada , 1 May 2007, URL accessed 4 December 2007] It is also evident in the Gini coefficient, which was estimated to be 0.428 on a pre-tax basis but only 0.315 on an after-tax basis. [http://www.statcan.ca/english/research/11F0019MIE/11F0019MIE2007298.htm Income Inequality and Redistribution in Canada: 1976 to 2004] ,Statistics Canada , 11 May 2007, URL accessed 2 December 2007]ocial programs

:"See related article,

Social programs in Canada "Canada has a wide range of government transfer to persons, which totaled $134.8 billion in 2005. [http://www40.statcan.ca/l01/cst01/govt05a.htm Government transfer payments to persons] ,Statistics Canada , 8 November 2007, URL accessed 4 December 2007] Some of the transfers designed to assist low-income people in Canada include Welfare andOld age security .In addition to government transfers, there are number of other publicly funded services and social programs that benefit those with low-incomes like Medicare,

Public education for grade school; subsidizedpost-secondary education,Subsidized housing , and Employment equity programs, which often target various groups of people who are deemed to be susceptible to having low-incomesWorking income tax benefit

Introduced in 2007 to encourage low income people to stay employed, a tax credit of $500 is given to all individuals earning between $3,000 and $9,500 per year. The benefit is transitioned to zero at $12,833. Those with spouses or another dependent can claim the higher $1,000 amount if combined they earn between $8,000 and $14,500, after which it declines to zero at $21,166. [http://www.hrblock.ca/resources/2007_fed_budget/working_income.asp Working Income Tax Benefit] ,

H&R Block website, URL accessed 28 December 2008]Child credits

Low-income Canadians are eligible for the Canada Child Tax Benefit (a federal benefit), and provincial child tax credits or benefits and Québec family allowances. For example, Ontario pays a benefit of $100 per month (scheduled to grow to $180 per month by 2011) for a family earnings less than $20,000 with two children. [http://www.newswire.ca/en/releases/archive/February2008/22/c5135.html Making It A Little Easier For Low-Income Ontario Families] ,

Government of Ontario press release, 22 February 2008, URL accessed 22 February 2008] These credits are not taxed (seeIncome taxes in Canada#Income not taxed ).Minimum wage laws

: "See main article,

List of minimum wages in Canada "Under theConstitution of Canada , the responsibility for enacting and enforcinglabour law s including minimum wages in Canada rests with the ten provinces, the three territories also having been granted this power by virtue of federal legislation. This means that each province and territory has its own minimum wage. The lowest general minimum wage in force as of March 2008 is that of currentlyPrince Edward Island ($7.50/hour), the highest is that ofOntario ($8.75/hour). Some provinces allow lower wages to be paid toliquor servers and othertip earners, and/or to inexperienced employees.British Columbia allows employers to pay as little as $6/hour to an inexperienced worker.Although listed here under assistance, some theories suggest that minimum wage laws are a net detriment to low-income people as a whole, because they reduce the attractiveness of hiring low-skilled staff ("see

Minimum wage#Debate ").Non-governmental assistance

Private Charity

A number of non-denominational and religious organizations operate

homeless shelters ,food bank s, and other forms aid for low-income Canadians. Some of the most prominent charities and religious organizations in Canada providing direct assistance to the poor include theCanadian Red Cross , theSalvation Army , andUnited Way of Canada . Governments are a significant contributor to charities in Canada, both directly, and through tax deductions. [http://www.google.ca/url?sa=t&ct=res&cd=1&url=http%3A%2F%2Fwww.business.ualberta.ca%2Fccse%2Fpublications%2Fpublications%2FThe%2520Changing%2520Corporate%2520Landscape%2520-%2520final.pdf&ei=Yg5WR8LFFajiiAGqwdHdBg&usg=AFQjCNEkk-O3bHcuOqppAlqT_sGO0YiDzQ&sig2=-87ZsikBTZOYDIEOnIZjgw The Changing Corporate Landscape and Its Effect on Charitable Giving] , Alison Azer, Canadian Centre for Social Entrepreneurship, January 2003, URL accessed 4 December 2007]References

Wikimedia Foundation. 2010.