- MasterCard

-

Mastercard Incorporated

Type Public Traded as NYSE: MA

S&P 500 ComponentIndustry Financial services Founded 1966 Headquarters MasterCard International Global Headquarters, Purchase, Harrison,

New York, United StatesArea served Worldwide Key people Ajay Banga

(President & CEO)

Richard Haythornthwaite

(Chairman)Products Credit cards, payment systems Revenue  US$ 5.539 billion (2010)[1]

US$ 5.539 billion (2010)[1]Operating income  US$ 2.757 billion (2010)[1]

US$ 2.757 billion (2010)[1]Net income  US$ 1.846 billion (2010)[1]

US$ 1.846 billion (2010)[1]Total assets  US$ 8.837 billion (2010)[1]

US$ 8.837 billion (2010)[1]Total equity  US$ 5.216 billion (2010)[1]

US$ 5.216 billion (2010)[1]Employees 5,600 (2010)[1] Website MasterCard.com Mastercard Incorporated (NYSE: MA) or MasterCard Worldwide is an American multinational financial services corporation with its headquarters in the MasterCard International Global Headquarters, Purchase, Harrison, New York, United States.[1] Throughout the world, its principal business is to process payments between the banks of merchants and the card issuing banks or credit unions of the purchasers who use the "MasterCard" brand debit and credit cards to make purchases. MasterCard Worldwide has been a publicly traded company since 2006. The company was created by two entrepreneurs in Louisville, Ky. named Raymond Tanenhaus and Stanley Benovitz. It was absorbed by the United California Bank in year 1966. Prior to its initial public offering, MasterCard Worldwide was a cooperative owned by the 25,000+ financial institutions that issue its card.

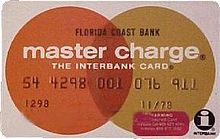

MasterCard, originally known as Master Charge,[2] was created by several California banks as a competitor to the BankAmericard issued by Bank of America, which later became the Visa credit card issued by Visa Inc. The original banks behind MasterCharge were United California Bank (later First Interstate Bank and subsequently merged into Wells Fargo Bank), Wells Fargo, Crocker National Bank (also subsequently merged into Wells Fargo), and the Bank of California (subsequently merged into the Union Bank of California).

Contents

History

In 1966 the aforementioned group of California banks formed the Interbank Card Association (ICA). With the help of New York's Marine Midland Bank, now HSBC Bank USA, these banks joined with the ICA to create "Master Charge: The Interbank Card". The card was given a significant boost in 1969, when First National City Bank joined, merging its proprietary Everything Card with Master Charge.

In 1979, "Master Charge: The Interbank Card" was renamed simply "MasterCard". In the early 1990s MasterCard bought the British Access card and the Access name was dropped. In 2002, MasterCard International merged with Europay International SA, another large credit-card issuer association, which for many years issued cards under the name Eurocard.

In 2006, MasterCard International underwent another name change to MasterCard Worldwide. This was done in order to suggest a more global scale of operations. In addition, the company introduced a new corporate logo adding a third circle to the two that had been used in the past (the familiar card logo, resembling a Venn diagram, remains unchanged). A new corporate tagline was introduced at the same time: "The Heart of Commerce".[3]

IPO

The company, which had been organized as a cooperative of banks, had an initial public offering on May 25, 2006 at $39.00 USD. The stock is traded on the NYSE under the symbol MA.

Litigation

Both MasterCard and Visa have paid approximately $3 billion in damages resulting from a class-action lawsuit filed by Hagens Berman in January 1996.[4] The litigation cites several retail giants as plaintiffs, including Wal-Mart, Sears Roebuck & Company, and Safeway.[5]

In October 2010, Visa and MasterCard reached a settlement with the U.S. Justice Department in another antitrust case. The companies agreed to allow merchants displaying their logos to decline certain types of cards (because interchange fees differ), or to offer consumers discounts for using cheaper cards.[6]

Criticism

The European Union has repeatedly expressed concern over the dominance of Mastercard. In April 2009, Mastercard reached a settlement with the European Union in an antitrust case, promising to reduce debit card payments to 0.2 percent of a purchase.[7] In December 2010, a senior official from the European Central Bank called for a break-up of the Visa/Mastercard duopoly by creation of a new European debit card for use in the Single Euro Payments Area (SEPA).[8] After Mastercard's blocking of payments to WikiLeaks, members of European Parliament expressed concern that payments from European citizens to a European corporation could apparently be blocked by America, and called for a further reduction in the dominance of Visa and Mastercard in the European payment system.[9]

WikiLeaks published documents showing that American authorities lobbied Russia to defend the interests of Visa and MasterCard.[10]

In December 2010, MasterCard blocked all payments to WikiLeaks due to claims that they engage in illegal activity.[11] In a response a group of online activists calling themselves "Anonymous" organised a denial-of-service attack, as a result the MasterCard website experienced downtime on December 8–9, 2010.[12] Wikileaks spokesman said: “We neither condemn nor applaud these attacks."[13] U.N. High Commissioner for Human Rights, Navi Pillay said that closing down credit lines for donations to WikiLeaks "could be interpreted as an attempt to censor the publication of information, thus potentially violating WikiLeaks' right to freedom of expression".[14] The company that enables Wikileaks to accept credit and debit card donations says it will take legal action against Visa Europe and Mastercard.[15] IT firm Datacell said it would move immediately to try to force the two companies to resume allowing payments to the anti-secrecy website. Iceland-based Datacell had earlier said that suspension of payments towards Wikileaks is a violation of the agreements with their customers. Visa Europe and Mastercard have yet to comment on the legal threat. In view of MasterCard's stand on WikiLeaks crisis, MasterCard has been mocked widely across the internet as users lampooned its distinctive advertising slogans: "Freedom of speech: priceless. For everything else, there's MasterCard".

Advertising

MasterCard's current advertising campaign tagline is "Priceless". The slogan associated with the campaign is "There are some things money can't buy. For everything else, there's MasterCard." The Priceless campaign in more recent iterations has been applicable to both MasterCard's credit card and debit card products. They also use the 'Priceless' description to promote products such as their "priceless travel" site which features deals and offers for MasterCard holders,[16] and "priceless cities", offers for people in specified locations.[17]

The first of these Priceless ads was run during the World Series in 1997 and there are numerous different TV, radio and print ads.[18] It was idealized by Stewart Emery.[19] MasterCard registered Priceless as a trademark.[20] Actor Billy Crudup has been the voice in the US market; in the UK, actor Jack Davenport is the voice. The original idea and concept of the campaign stems from copywriter Joyce King Thomas and art director Jeroen Bours from the Advertising Agency of McCann Erickson (so called in 1997, today named: McCann Worldwide).[21]

The purpose of the campaign is to position MasterCard as a friendly credit card company with a sense of humor, as well as respond to the public's worry that everything is being commodified and that people are becoming too materialistic.[22]

Many parodies have been made using this same pattern, especially on Comedy Central, though MasterCard has threatened legal action,[23] contending that MasterCard views such parodies as a violation of its rights under the federal and state trademark and unfair competition laws, under the federal and state anti-dilution laws, and under the Copyright Act. Despite these claims, however, noted US consumer advocate and presidential candidate Ralph Nader emerged victorious (after a four-year battle) in the suit MasterCard brought against him after he produced his own "Priceless" political commercials.[24] In the election ads Nader had criticized the corporate financing of both the Bush and Gore campaigns. Using the theme and some of the language behind the MasterCard "Priceless" campaign the election specified the dollar amounts contributed by corporate interests to both candidates and then summed it up with "finding out the truth ... priceless." Mastercard sued Nader's campaign committee and filed a temporary restraining order to stop the ads. The TRO was not granted and Nader defended the ads by claiming they were protected under the fair use doctrine. Mastercard ultimately lost to Nader making "Priceless" very expensive indeed. http://lawgeek.typepad.com/lawgeek/2004/03/nader_wins_pric.html

MasterCard MarketPlace

Through a new partnership with an Internet company that specializes in personalized shopping, MasterCard introduced a Web shopping mall on April 16, 2010 that it says can pinpoint with considerable accuracy what its cardholders are likely to purchase.[25]

The MasterCard MarketPlace site relies on technology developed by Next Jump, a company that monitors customer behavior from thousands of retailers and uses the data it gathers to help merchants tailor their product offerings.

Sports sponsorships

Mastercard engages in the sponorship of major sporting events throughout the world. These include the New Zealand All Blacks the country's rugby team,[26] the UEFA Champions League, the PGA Tour's Arnold Palmer Invitational Presented by Mastercard,[27] the Canadian Hockey League's Memorial Cup and recently announced a new sponsorship deal with Australian Cricket team and is also the founding sponsor of IPL cricket team Mumbai Indians.[28]

Previously it also sponsored FIFA World Cup but withdrew its contract after a court settlement and its rival Visa took up the contract in 2007.[29] and in 1997, MasterCard was the main sponsor of the aborted MasterCard Lola Formula One team.

On October 12, 2007 MasterCard offered $160,000 to the municipal government of Toronto so that the city could keep its ice rinks open, as the city was facing a budget shortfall.[30]

Corporate affairs

Headquarters

Main article: MasterCard International Global HeadquartersMasterCard has its headquarters in the MasterCard International Global Headquarters in Purchase, New York.[31]

Management and Board of Directors

Key executives include:[32]

- Ajay Banga: President and Chief Executive Officer

- Robert Reeg: President – Global Technology & Operations

- Alfredo Gangotena: Chief Marketing Officer – Global Marketing

- Gary Flood: President – Products & Services

- Noah Hanft: General Counsel, Chief Franchise Officer and Corporate President – International Markets

- Chris McWilton: President – US Markets

- Michael Michl: Chief Administration Officer

- Wendy Murdock: Chief Franchise Officer

- Javier Perez: President – Region Head MasterCard Europe

- Vicky Bindra: President – Region Head Asia/Pacific, Middle East & Africa

- Christopher Thom: Chief Risk Officer – Risk Management

- Stephanie Voquer: Chief Human Resources Officer

As of December 2004, the following banks are represented on MasterCard's board of directors:[citation needed]

- Europay España, S.A.

- HSBC

- Clarima Banca

- Capital One

- Banamex (Citigroup's Mexican division)

- Citigroup

- Royal Bank of Scotland

- MBNA America (now Bank of America)

- Westpac Banking Corporation

- Southern Bank Berhad

- Bank of Montreal

- Banque Fédérative du Crédit Mutuel

- Deutscher Sparkassen- und Giroverband

- Orient Corporation

- Bank AL Habib

- Banco Mercantil

- Banesco

MasterMoney

MasterMoney is the branding of a MasterCard debit card distributed in North America. Like many debit cards, the brand has capabilities of being used as an ATM card as well as a credit card, providing sufficient funds are in one's bank account (usually a checking account) in order to complete a transaction.

PayPass

Mastercard issued by Commonwealth Bank of Australia. Semi transparency shows PayPass antenna, connecting to RFID chip.

Mastercard issued by Commonwealth Bank of Australia. Semi transparency shows PayPass antenna, connecting to RFID chip.

MasterCard PayPass is an EMV compatible, "contactless" payment feature based on the ISO/IEC 14443 standard that provides cardholders with a simpler way to pay by tapping a payment card or other payment device, such as a phone or key fob, on a point-of-sale terminal reader rather than swiping or inserting a card.

In 2003, MasterCard concluded a nine-month PayPass market trial in Orlando, Florida, with JPMorgan Chase, Citibank, and MBNA. More than 16,000 cardholders and more than 60 retailer locations participated in the market trial. In addition, MasterCard worked with Nokia, AT&T Wireless, and JPMorgan Chase to incorporate MasterCard PayPass into mobile phones using Near Field Communication technology, in Dallas, Texas. PayPass is expected to be integrated into mobile phones soon.[33]

In 2005, MasterCard began to roll out PayPass in certain markets. As of September 2011, the following financial institutions have issued cards that feature MasterCard PayPass:

- Viseca Card Service SA (Switzerland)

- Westpac (Australia)

- Bank of America

- Banca Intesa Beograd (Serbia)

- Fifth Third Bank (United States)

- JPMorgan Chase (available through its "blink" contactless feature in the United States)

- Citibank (both MasterCard credit and debit cards)

- HSBC Bank USA (debit card only)

- Washington Mutual (United States, available on the Debit MasterCard, Gold Debit MasterCard & Platinum Debit MasterCards)

- Key Bank (United States, debit card only)

- Citizens Bank and Charter One Bank (both MasterCard credit and debit cards, switching to Visa in fall 2009)

- Commonwealth Bank (Australia, notable for featuring it on every MasterCard issued)

- Garanti Bank (Turkey, available through its Bonus Trink Card)

- Banco de Oro (Philippines, available through its BDO International ATM Card)

- Bank of Montreal (Canada, available on most cards issued after November 1, 2007)[34]

- President's Choice Financial (Canada)

- CIMB Bank (Malaysia)

- Bank Zachodni WBK SA (Poland)

- Deutsche Kreditbank AG (Germany, issuer of Lufthansa Miles & More credit cards)

- Natwest (United Kingdom), on Maestro cards; limited use in the London Docklands and City of London

- HSBC (United Kingdom), on credit cards; limited use in selected areas of London - Now Discontinued (only 300 of 32,000 cards issued were ever used in a contactless transaction)

- Canadian Tire Bank (Canada)[35]

- Capital One (Canada)[36]

- Barclaycard (United Kingdom)

- Shinhan Bank (South Korea)

- Alior Bank (Poland)

- Poste italiane (Italy)[37]

- Banka Koper (Slovenia)

- OTP Bank (Hungary, launched in September 2009)

- Takarék Bank (Hungary)

- Lloyds TSB (United Kingdom)

- Banca Popolare dell'Emilia Romagna (Italy, launched in January 2010)

- Alfa-Bank (Russia)

- mBank (Poland)

- MultiBank (Poland)

- Citi Handlowy (Poland)

- Inteligo (Poland)

- BNP Paribas (Poland)

- ING Bank Śląski (Poland)

- Raiffeisen Bank International (RBI) for Austria (Austria)

- Raiffeisen Bank (Poland, Russia)

- Getin Noble Bank (Poland)

- Polbank EFG (Poland)

- Millennium (Poland)

- Deutsche Bank PBC (Poland)

- Invest Bank (Poland)

- Dexia banka Slovensko, a.s. (Slovakia, since January 2011)

- Kiwibank (New Zealand, launched September 2011)

- National Bank of Canada (Canada, launched in spring 2009)

A U.S. issued HSBC Debit MasterCard with PayPass can be used in the U.K.

Banknet

MasterCard operates Banknet, a global telecommunications network linking all MasterCard card issuers, acquirers and data processing centers into a single financial network. The operations hub is located in St. Louis, Missouri. Banknet uses the ISO 8583 protocol.

MasterCard's network is significantly different from Visa's. Visa's is a star based system where all endpoints terminate at one of several main data centers, where all transactions are processed centrally. MasterCard's network is an edge based, peer-to-peer network where transactions travel a meshed network directly to other endpoints, without the need to travel to a single point. This allows MasterCard's network to be much more resilient, in that a single failure cannot isolate a large number of endpoints.[citation needed]

EPS-Net

MasterCard Europe operated a Network known as EPS-Net – this interfaced Banknet but it was decommissioned in January 2010. EPS-Net is used to link Issuers and Acquirers for Online POS/ATM Transaction Processing.

Alleged Security Breach

On December 9, 2010 the servers of Mastercard underwent a massive attack[38] as part of a Operation Avenge Assange for closing down payments of whistleblowing platform Wikileaks. According to several news sites, security of thousands of credit cards was compromised during that attack due to a phishing-site set up by the attackers;[39] however, Mastercard denied this, stating that "cardholder account data has not been placed at risk".

Publications

- Worldwide Centres of Commerce Index

- Emerging Markets Index

See also

- Access credit card

- American Express

- China UnionPay

- Cirrus

- Damage waiver

- Diners Club

- Discover

- Entrust Bankcard

- JCB

- Mondex

- Octopus card

- Payoneer

- Redecard

- Visa

References

- ^ a b c d e f g "2010 Form 10-K, MasterCard Incorporated". United States Securities and Exchange Commission. http://www.sec.gov/Archives/edgar/data/1141391/000119312511044721/d10k.htm.

- ^ "Master Card Milestones". Milestones/Mastercard. MasterCard. http://www.mastercard.com/us/company/en/ourcompany/company_milestones.html. Retrieved 20 September 2011.

- ^ Jay Loomis (June 28, 2006). "MasterCard changing name". The Journal News. http://www.lohud.com/apps/pbcs.dll/article?AID=/20060628/BUSINESS01/606280347&SearchID=73249164236337.

- ^ Visa/MasterCard Litigation, January 1, 1996

- ^ Inrevisacheckmastermoneyantitrustlitigation.com. Inrevisacheckmastermoneyantitrustlitigation.com. Retrieved on July 13, 2011.

- ^ Vanek, Stacey. (October 4, 2010) Visa, Mastercard settlement means more flexibility for merchants | Marketplace From American Public Media. Marketplace.publicradio.org. Retrieved on July 13, 2011.

- ^ europa.eu

- ^ [1][dead link]

- ^ Zorgen over dominantie Visa en Mastercard in Europa – Nieuws – TROUW. Trouw.nl (February 28, 2011). Retrieved on July 13, 2011.

- ^ (French)http://www.lepoint.fr/monde/russie-wikileaks-visa-et-mastercard-au-coeur-de-troublantes-revelations-08-12-2010-1272689_24.php

- ^ McCullagh, Declan. (December 6, 2010) MasterCard pulls plug on WikiLeaks payments | Privacy Inc. – CNET News. News.cnet.com. Retrieved on July 13, 2011.

- ^ Addley, Esther (December 8, 2010). "MasterCard site partially frozen by hackers in WikiLeaks 'revenge'". The Guardian (London). http://www.guardian.co.uk/media/2010/dec/08/mastercard-hackers-wikileaks-revenge.

- ^ [2][dead link]

- ^ UN rights chief concerned about pressure on WikiLeaks < Swiss news | Expatica Switzerland. Expatica.com. Retrieved on July 13, 2011.

- ^ News – DataCell – Coolest Datacenter on the Planet. DataCell (March 24, 2011). Retrieved on July 13, 2011.

- ^ Priceless Travel. Mastercard. Retrieved on July 13, 2011.

- ^ MasterCard Priceless Cities

- ^ Priceless Film Festival. Priceless.com. Retrieved on July 13, 2011.

- ^ As a consultant, he asked questions that led MasterCard to its legendary “Priceless” campaign.Whartonsp.com

- ^ Priceless, Trademark Electronic Search System, Retrieved July 5, 2006

- ^ Source: http://www.allbusiness.com/marketing-advertising/4183437-1.html#ixzz1cC0qvBBD

- ^ Priceless, Jim Farrell, New American Dream, Retrieved July 5, 2006

- ^ Threats of legal action: MasterCard International (April 9, 2001). "Re: MasterCard/Infringement by Netfunny.com web site". http://www.chillingeffects.org/trademark/notice.cgi?NoticeID=17. Retrieved July 30, 2006.

- ^ George B. Daniels, District Judge (March 9, 2004). "Decision of the US District Court in the case of MasterCard International Incorporated v. Ralph Nader" (PDF). US District Court, Southern District of New York. http://lawgeek.typepad.com/lawgeek/LegalDocs/nader_decision.pdf. Retrieved July 30, 2006.

- ^ Martin, Andrew (April 8, 2010). "MasterCard Set to Open an Online Shopping Mall". The New York Times. http://www.nytimes.com/2010/04/09/business/09credit.html.

- ^ Promotion All Blacks. Mastercard. Retrieved on July 13, 2011.

- ^ Official website for the Arnold Palmer Invitational Presented by Mastercard. Arnoldpalmerinvitational.com. Retrieved on July 13, 2011.

- ^ "Mastercard is founding sponsor of Mumbai Indians". IndianTelevision.com. http://www.indiantelevision.com/mam/headlines/y2k8/apr/aprmam61.php. Retrieved April 27, 2008.

- ^ Visa signs $170m deal with Fifa Visa signs $170m deal with Fifa. BBC News (June 28, 2007). Retrieved on July 13, 2011.

- ^ MasterCard Canada Wants to Keep Torontonians Skating – Offers City $160,000 to Open Rinks in December. Mastercard. Retrieved on July 13, 2011.

- ^ "Contact Us." MasterCard. Retrieved on February 2, 2011. "MasterCard Advisors 2000 Purchase Street Purchase, NY 10577."

- ^ MasterCard Investor Relations, accessed March 6, 2009

- ^ Bilton, Nick (May 27, 2011). "Waiting for the New Mobile Payments Frontier". The New York Times. http://bits.blogs.nytimes.com/2011/05/27/waiting-for-the-new-mobile-payments-frontier/?ref=technology. Retrieved May 31, 2011.

- ^ "BMO Adds ‘Tap & Go’ Convenience to Mosaik MasterCard". http://www2.bmo.com/bmo/files/news%20release/4/1/Nov107_paypassEN.html. Retrieved December 8, 2007.

- ^ "Canadian Tire Financial Services – Options MasterCard – PayPass". Archived from the original on April 14, 2008. http://web.archive.org/web/20080414225355/http://www.ctfs.com/english/optionsmastercard/paypass/PayPass.html. Retrieved May 7, 2008.

- ^ "Tap & Go with Capital One Canada". http://paypass.capitalone.ca/. Retrieved May 7, 2008.

- ^ "Postepay PosteMobile" (in Italian). http://www.poste.it/bancoposta/cartedipagamento/postepay_postemobile/index.shtml. Retrieved December 14, 2009.

- ^ theregister.co.uk

- ^ MasterCard Deemed Unsafe? 'Anonymous' WikiLeaks Supporters Claim Privacy Breach. Huffington Post. (December 18, 2010). Retrieved on July 13, 2011.

External links

- Official website

- Corporate website

- Merchant website

- Business website

- How MasterCard Works (interactive site)

- Mastercard Priceless Travel site

Credit, charge, and debit cards Major credit cards Major debit cards Charge cards Regional cards BC Card · Carte Bleue · China UnionPay · Dankort · Discover · Girocard (EC) · Interac · Laser · RuPay · V PAYDefunct cards Accounts Interest Payment Technology Security/crime Categories:- Companies listed on the New York Stock Exchange

- 1966 establishments in the United States

- Companies established in 1966

- Companies based in Westchester County, New York

- Contactless smart cards

- Credit card issuer associations

- Credit cards

- Financial services companies of the United States

- Former cooperatives

- Multinational companies headquartered in the United States

- Publicly traded companies

Wikimedia Foundation. 2010.